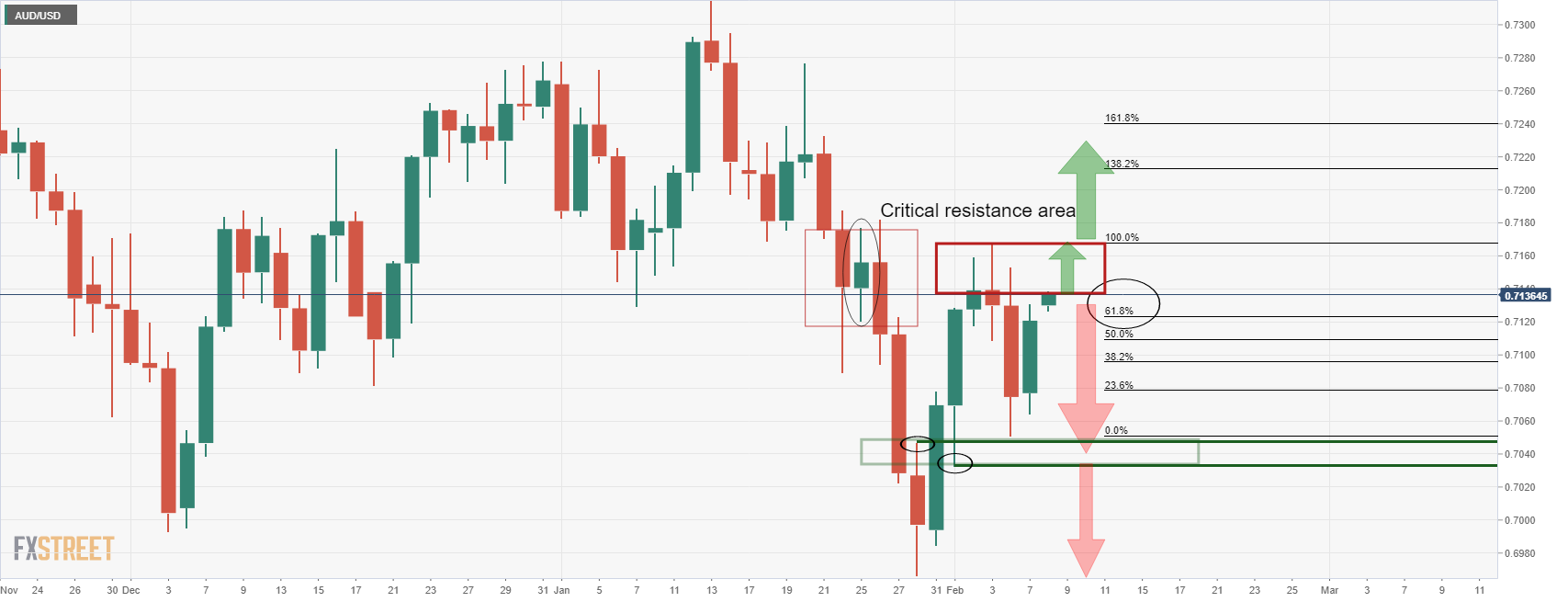

AUD/USD Price Analysis: Bears could start to emerge soon, eyes on the H1 0.7105 swing lows

- AUD/USD bulls are challenging the bear's commitments a critical area of resistance.

- The weekly bears are eyeing a break of 0.7105, then 0.7050 for a test to 0.7000.

AUD/USD has continued to chip into the daily resistance ahead of what could now start to shape up to be a more volatile number of days ahead. The US dollar is going to be under scrutiny in the next 72 hours as markets get set for inflation data and start second-guessing the Federal Reserve's moves in Mach. From a technical standpoint, that leaves the downside vulnerable while the price remains below the 0.7180's as follows:

AUD/USD daily chart

The price is fairly bid above the 61.8% ratio but sellers may emerge soon if the bulls fail to take out the critical resistance area near 0.7180. A move lower will likely see 0.7050 in the near future that guards 0.70 the figure as per the weekly chart's downside initial target:

AUD/USD H1 chart

From an hourly perspective, the H1 0.7105 swing lows will be key. Bbelow there, the flood gates could open up for the bears.