EUR/USD on a firmer footing, approaches 1.1800

- EUR/USD reverses the recent weakness and re-targets 1.1800.

- German IFO survey came in short of estimates in July.

- US housing data, Dallas Fed Index next in the US docket.

The single currency leaves part of the recent selling pressure behind and now pushes EUR/USD closer to the key 1.1800 neighbourhood on Monday.

EUR/USD up on USD-weakness

After two consecutive daily pullbacks, EUR/USD now regains the smile and looks to retake the area further north of the 1.1800 mark in a context favourable to the risk-associated universe.

In fact, investors appear to have already fully digested the latest ECB event, where the central bank re-affirmed its dovish message and left any potential announcement on the asset purchase programme and/or the PEPP to the September meeting along with an update to the bank’s projections.

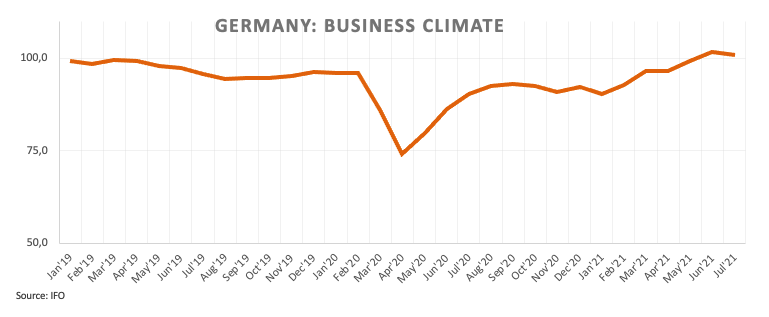

The improved mood in spot re-emerges despite the German IFO survey came in short of forecasts for the month of July. Indeed, the Business Climate eased to 100.8 (from 101.7) while Current Conditions and Expectations also receded to 100.4 and 101.2, respectively.

Data wise across the ocean, New Home Sales are due seconded in relevance by the Dallas Fed index.

What to look for around EUR

The downward path in EUR/USD appears unabated so far, although the mid-1.1700s offer quite a decent support for the time being. As usual in past weeks, price action around the pair is expected to exclusively hinge on dollar dynamics, particularly following the FOMC event in June. On the euro side of the equation, the re-affirmed dovish stance from the ECB (as per its latest meeting) is expected to keep the upside limited in spot despite auspicious results from key fundamentals and the persistent high morale in the region.

Key events in the euro area this week: German IFO survey (Monday) – German GfK Consumer Confidence (Wednesday) – German labour market report/Advanced July CPI, EMU final Consumer Confidence (Thursday) – German, EMU flash Q2 GDP/EMU advanced July CPI (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the Delta variant of the coronavirus and pace of the vaccination campaign. Probable political effervescence around the EU Recovery Fund. German elections. Investors’ shift to European equities in the wake of the pandemic.

EUR/USD levels to watch

So far, spot is gaining 0.25% at 1.1796 and faces the next up barrier at 1.1830 (weekly high Jul.22) followed by 1.1895 (weekly high Jul.6) and finally 1.1975 (weekly high Jun.25). On the flip side, a breakdown of 1.1751 (monthly low Jul.21) would target 1.1704 (2021 low Mar.31) en route to 1.1602 (November 2020 low).