Back

13 Apr 2021

USD/JPY Price Analysis: Bears seek downside continuation

- Bears are ready to pounce at this juncture with a focus on near term support.

- Resistance on the daily time frame exposes 4-hour support.

USD/JPY is failing to convince an upward trajectory and the focus is on the downside as the bulls meet a significant Fibonacci retracement area at a confluence of resistance structure.

The following illustrates where the next downside opportunity comes in:

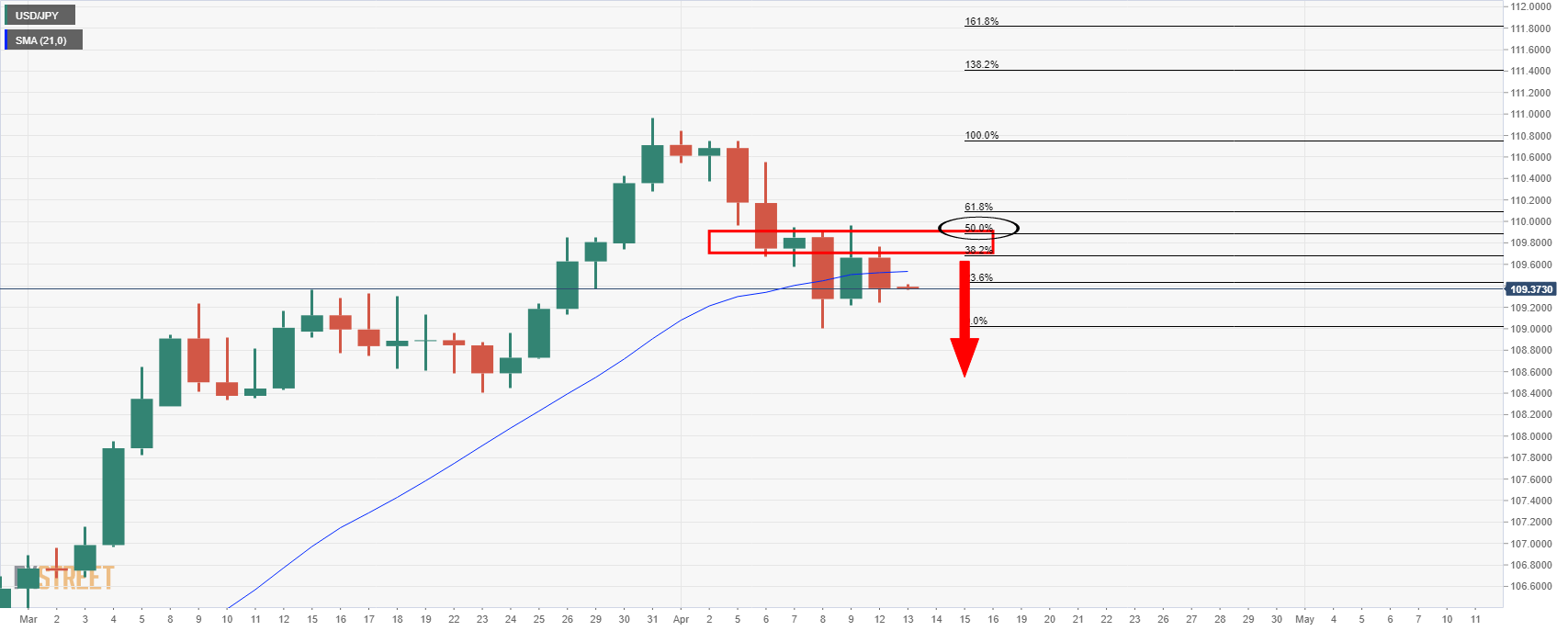

Daily chart

The bulls are testing a critical daily resistance at this juncture. Failures here open risk to the downside.

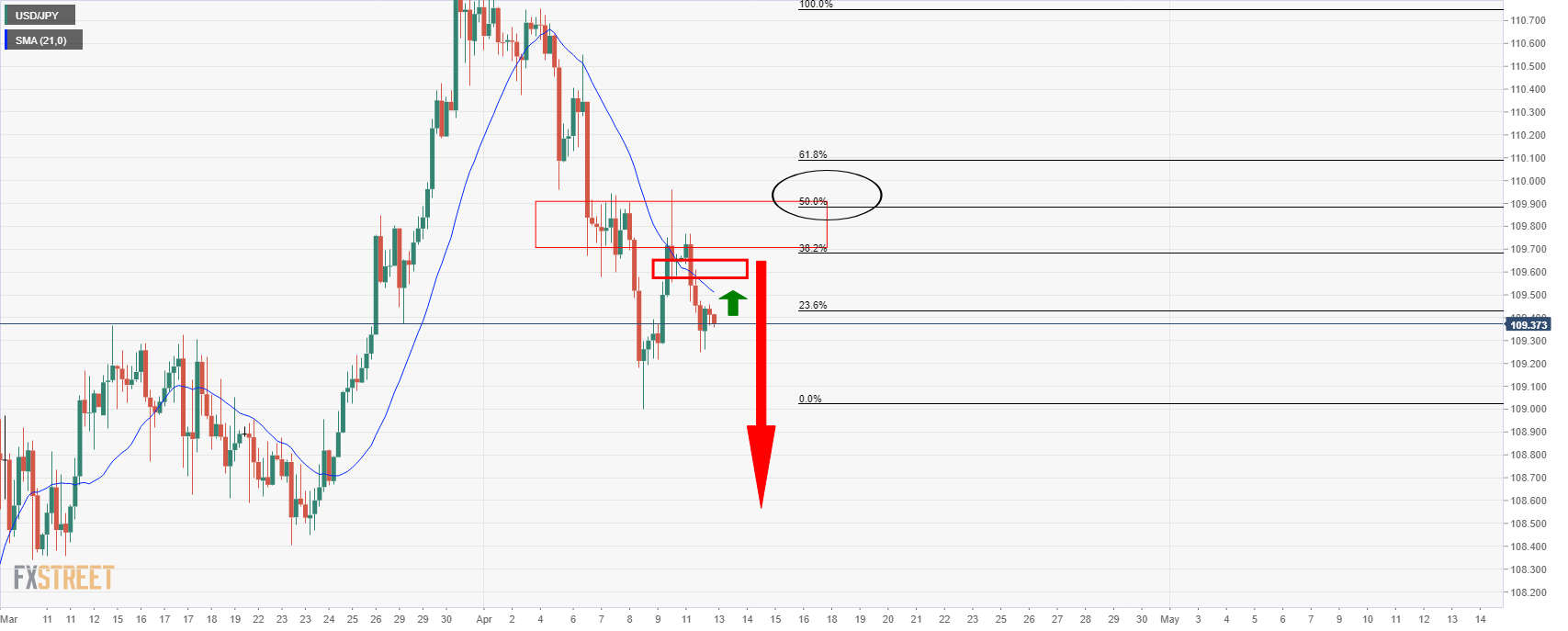

4-hour chart

There are still prospects of a last-minute test of 4-hour resistance prior to the daily downside continuation.