Gold Price Analysis: XAU/USD stays in consolidation phase below $1,730

- XAU/USD is struggling to make a decisive move in either direction.

- $1,720 aligns as key support in the near-term.

- Additional gains are likely if gold manages to break above $1,735.

The XAU/USD pair is moving up and down in a tight range below $1,730 on Monday as the trading action remains choppy on Easter Monday. As of writing, gold was down 0.2% on a daily basis at $1,736.

Gold technical outlook

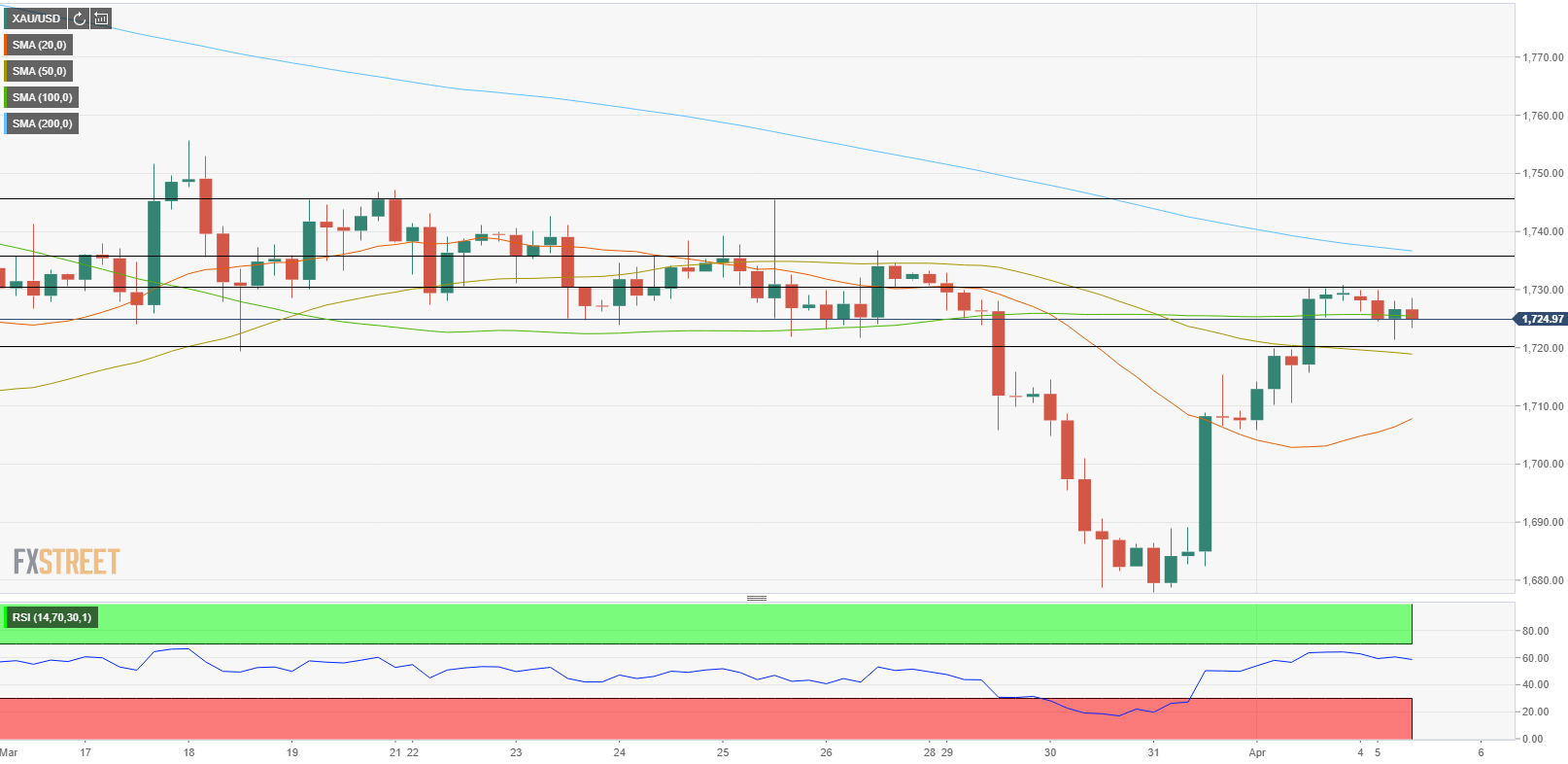

On the four-hour chart, the 100-period SMA is located just a little below the price, limiting the downside for the time being. Meanwhile, the Relative Strength Index (RSI) indicator on the same chart is moving sideways around 60, suggesting that gold stays neutral with a bullish bias in the short term.

The initial resistance is located at $1,730 ahead of $1,735 (200-period SMA). If a four-hour candle manages to close above that level, gold could push higher toward the next significant hurdle at $1,745 (static level).

On the downside, the first support is located at $1,725 (100-period SMA) before $1,720 (static level, 50-period SMA) and $1,708 (20-period SMA).

Additional levels to watch for