NZD/USD Price Analysis: Firmer above key SMA confluence, eyes monthly resistance

- NZD/USD takes bids near intraday high following its bounce off 0.7205.

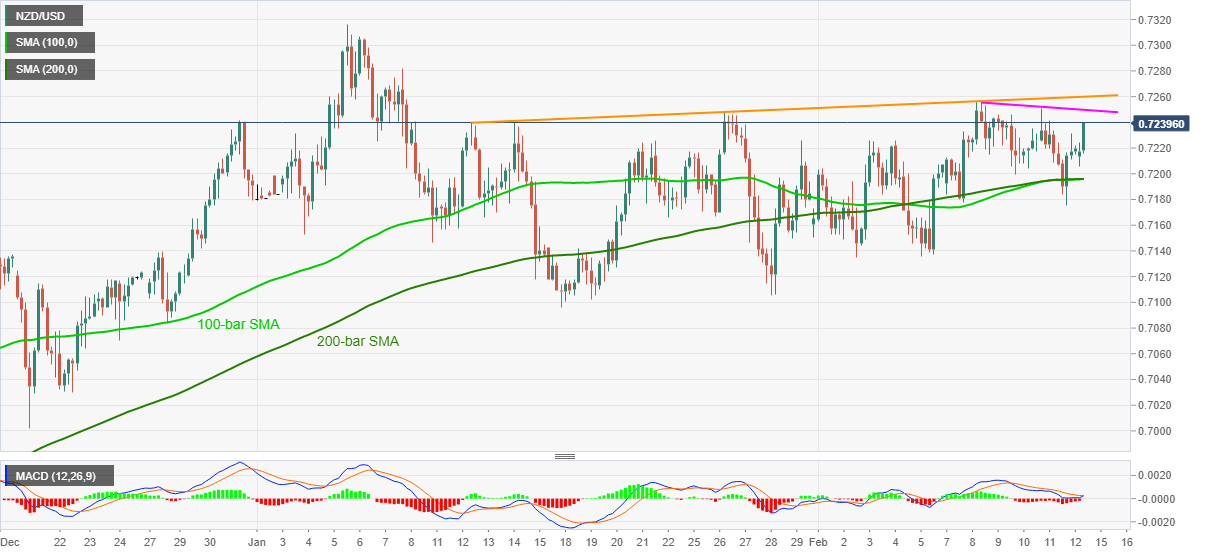

- Successful recovery moves from 100, 200-bar SMA propels the quote.

- Weekly hurdle tests intraday bulls ahead of one-month-old resistance line.

NZD/USD stays on the front foot, currently up 0.25% at intraday high of 0.7239, during early Monday. The pair earlier dropped 0.7205 remained well above a convergence of 100-bar and 200-SMA, which in turn took clues from the MACD turn in favor of the bulls to pleas the bulls.

Considering the quote’s sustained trading beyond the key SMAs, coupled with the MACD signals, NZD/USD is rising towards a one-week-old resistance line, at 0.7250 now. However, the pair’s further upside will be challenged by an ascending resistance line from January 13, near 0.7260.

If at all the NZD/USD bulls keep the reins above 0.7260, January 08 peak surrounding 0.7280 and the 0.7300 round-figure could challenge the north-run targeting the yearly high of 0.7316.

Alternatively, a downside break of the SMA confluence near 0.7195 should drop below Friday’s low of 0.7175 to recall the NZD/USD sellers targeting the monthly low close to 0.7130.

It should, however, be noted that the bears remain cautious unless witnessing a fresh low of the year, currently around 0.7095.

NZD/USD four-hour chart

Trend: Further upside expected