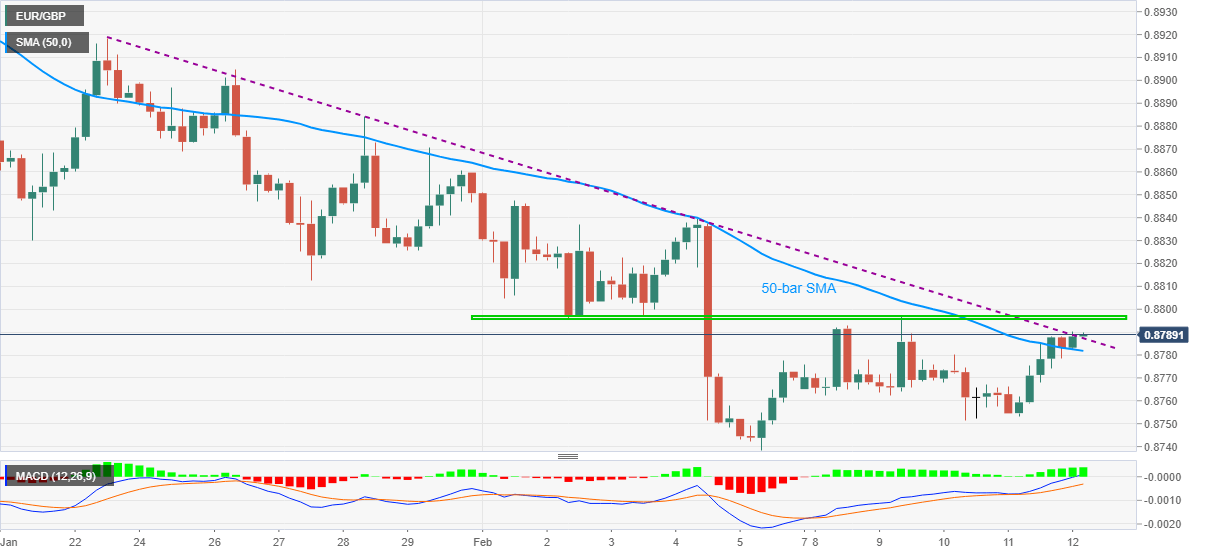

EUR/GBP Price Analysis: Pierces three-week-old resistance ahead of UK GDP

- EUR/GBP takes bids near the weekly top, extends run-up beyond 50-bar SMA.

- Bullish MACD, anticipated weakness in UK GDP suggest pair’s further upside.

- Lows marked during early February probes bulls targeting the monthly top.

EUR/GBP rises to 0.8789, up 0.09% intraday, ahead of Friday’s London open. In doing so, the pair crosses a downward sloping trend line from January 22.

Also favoring the buyers could be the bullish MACD signals and sustained trading above 50-bar SMA. Additionally, expected disappointment from the preliminary reading of the UK’s Q4 GDP offers extra push to EUR/GBP prices to the north.

Read: UK GDP Preview: Buy the rumor, sell the fact? BOE's bullish stance may backfire

However, lows marked during February 02 and 03, around 0.8795-8800, become a tough nut to crack for the EUR/GBP bulls, a break of which could attack the monthly top near 0.8850.

On the contrary, the pair’s failure to stay beyond 0.8785 can direct sellers to break the 50-bar SMA level of 0.8750, which in turn opens the door for the extra downside towards the monthly low of 0.8738.

In a case where sterling bulls dominate past-0.8738, the EUR/GBP will battle the 0.8700 round-figure before targeting April 2020 low near 0.8670.

EUR/GBP four-hour chart

Trend: Further upside expected