Gold Price Analysis: $1883 is the level to beat for XAU/USD bears – Confluence Detector

Gold (XAU/USD) enjoyed a good two-way price action on Wednesday but reversed most gains while settling around $1900. The yellow metal wavers in familiar ranges around $1900 so far this Thursday, as investors continue to favor the safe-haven US dollar amid fading hopes of a US fiscal stimulus package and a steep rise in coronavirus cases across Europe.

Gold rallied as high as $1912 after the dollar came under pressure amid a surge in GBP/USD on renewed Brexit optimism. Although the bulls failed to sustain at higher levels, technically the path of least resistance remains to the downside.

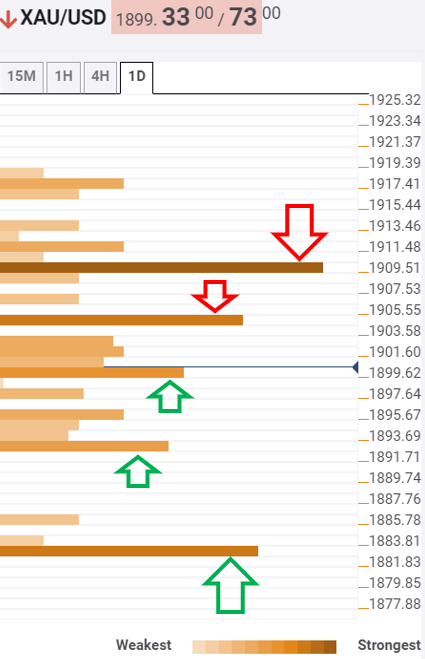

Gold: Key resistances and supports

The Technical Confluences Indicator shows that the bright metal is battling a minor support line at $1900, where the SMA10 one-hour lies.

A breach of the latter could see a dense cluster of support levels tested around $1893, which the convergence of the previous low on four-hour and pivot point one-week S1.

Sellers would regain complete control below that level, as they prepare to challenge the next significant cap at $1883, the intersection of the previous day low and Fibonacci 23.6% one-month.

To the upside, a firm break above the minor barrier at $1904, the convergence of the Fibonacci 38.2% one-month and SMA50 four-hour, is needed to propel a fresh leg higher.

Further north, powerful resistance at $1910 will be critical to negate the near-term bearish bias. That level is the meeting point of the Fibonacci 38.2% one-week and Bollinger Band one-hour Upper.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence