Back

15 Oct 2020

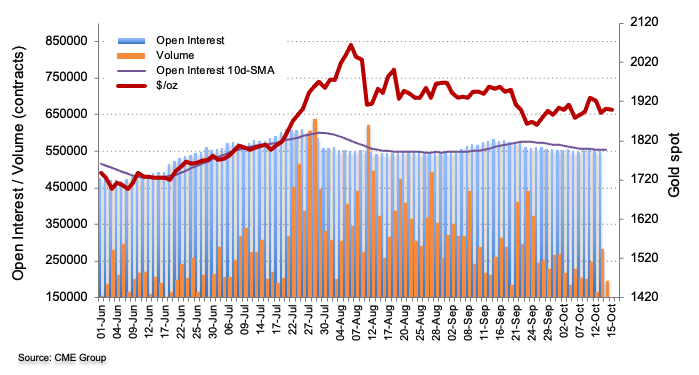

Gold Futures: Upside lacks conviction

Traders reduced their open interest positions in gold futures markets for the third session in a row on Wednesday, this time by around 2.6K contracts and according to preliminary readings from CME Group. In the same direction, volume shrunk by around 88.7K contracts amidst the prevailing erratic trend.

Gold looks consolidative between the 55-/100-day SMAs

Prices of the ounce troy of gold continue to navigate between the 55-day SMA ($1,937) and the 100-day SMA ($1,873) so far. Wednesday’s positive price action in the yellow metal was amidst shrinking open interest and volume, supporting the view that extra gains appear somewhat contained.