When are the Eurozone Preliminary CPIs and how could they affect EUR/USD?

Eurozone Preliminary CPIs overview

Eurostat will publish the first estimate of Eurozone inflation figures for July at 0900 GMT this Friday.

The headline CPI is seen a tad lower at 0.2% YoY while the core inflation is expected to hold steady at 0.8% YoY during the reported month.

At the same time, the bloc’s Preliminary GDP report for Q2 will be published, with the headline figures seen arriving at -12% QoQ vs. -3.6% previous. On an annualized basis, Eurozone GDP is likely to contract 14.5% vs. -3.1% last.

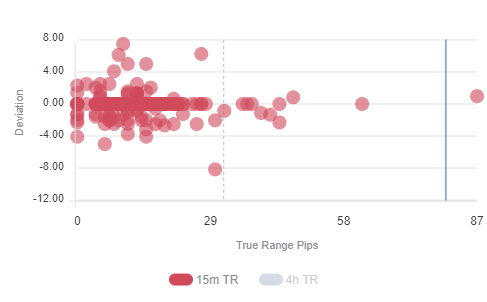

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 5 and 30 pips in deviations up to 4 to -4, although in some cases, if notable enough, a deviation can fuel movements of up to 45-50 pips.

How could affect EUR/USD?

Haresh Menghani, FXStreet's Analyst, offers important technical levels ahead of the key release: “any meaningful pullback might still be seen as a buying opportunity and seems more likely to find decent support near the mentioned resistance breakpoint, around the 1.1820-15 region. A subsequent slide below the 1.1800 mark might lead to some additional weakness and drag the pair further towards the 1.1760-55 intermediate support en-route the overnight swing low, around the 1.1730 region.”

“On the flip side, the 1.1935-40 region seems to be the next relevant target for bulls, which is followed by the 1.1975-80 zone ahead of the key 1.2000 psychological mark,” Haresh adds.

Key notes

EUR/USD Forecast: Correction coming? The dollar's reasons to dive do not mean a one-way street

ECB's Lagarde: We have to maintain safety net at least until June 2021

French FinMin Le Maire: GDP figures were not as bad as some had feared

About Eurozone Preliminary CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).