Back

15 Jun 2020

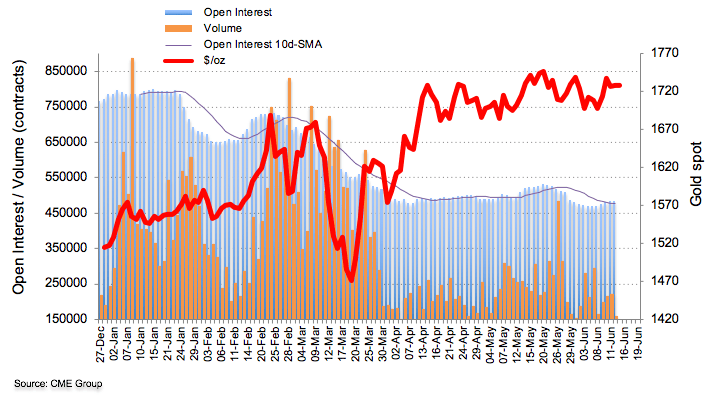

Gold Futures: Look neutral/bearish near-term

Open interest in Gold futures markets rose for the fourth consecutive session on Friday, this time by around 1.5K contracts according to preliminary figures from CME Group. On the other hand, volume reversed three consecutive builds and shrunk by around 61.1K contracts.

Gold still looks capped by $1,760/oz

Friday’s small uptick in prices of the ounce troy of gold met once again strong resistance in the $1,740 region amidst rising open interest and a pullback in volume. That said, price action of the precious metal could attempt some consolidation in the short-term, although a breakout of the $1,740 area could trigger a potential test of the 2020 high around $1,760 per ounce.