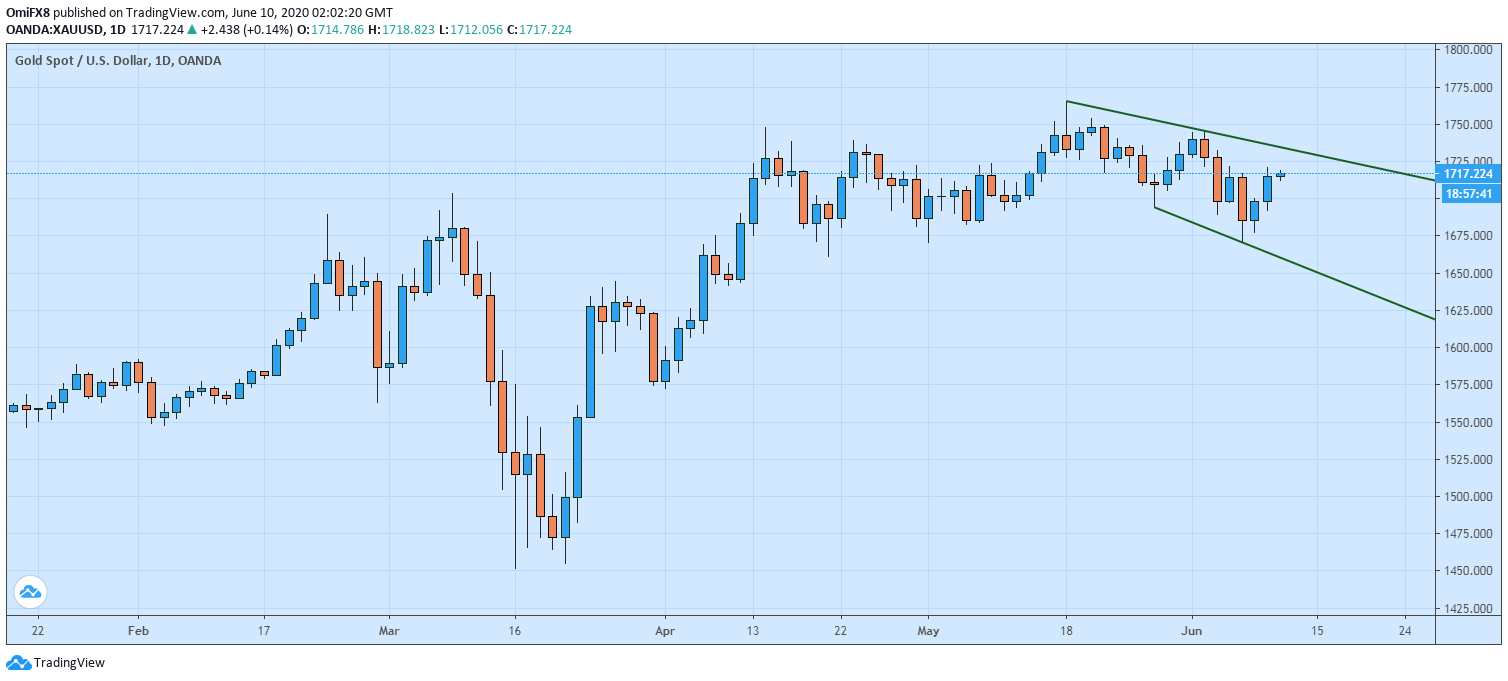

Gold Price Analysis: Friday's drop erased, but bearish channel intact

- Gold remains stuck in the falling channel despite the two-day rally.

- A move above $1,734 is needed to confirm a bullish breakout.

Gold jumped nearly 1% on Tuesday, extending Monday's 0.77% rise. The two-day winning trend has erased Friday's decline from $1,716 to $1,1670.

Even so, it is too early to call a bullish revival. This is because the yellow metal is still trapped in the bearish (falling) channel represented by trendlines connecting May 18 and June 2 highs and May 27 and June 5 lows.

At press time, the yellow metal is trading near $1,716 and the upper end of the channel is located at $1,734. A close above that level would confirm an end of the pullback from the May 18 high of $1,765 and put the bulls back into the driver's seat.

A breakout, if confirmed, would open the doors to a re-test of $1,765. Meanwhile, on the lower side, Tuesday's low of $1,692 is key support, which, if breached, will likely yield a slide to the channel support, currently at $1,660.

Daily chart

Trend: Bearish

Technical levels