EUR/USD leaps to 2-day high near 1.0850 on US data

- EUR/USD turns positive and clinches 2-day tops.

- Poor US Retail Sales undermines the momentum in the dollar.

- US Consumer Sentiment is next on tap on Friday.

EUR/USD has quickly broken above the previous consolidative theme and reached the area of 2-day highest in the 1.0845/50 band ono renewed selling pressure in the buck.

EUR/USD stronger post-US data

EUR/USD managed to reverse the initial pessimism and regained the upper hand after the selling pressure around the greenback gathered further traction in the wake of ugly data releases.

Indeed, US headline Retail Sales contracted markedly by 16.4%inter-month during April, while core sales also dropped by 17.2%, both prints exceeding previous expectations.

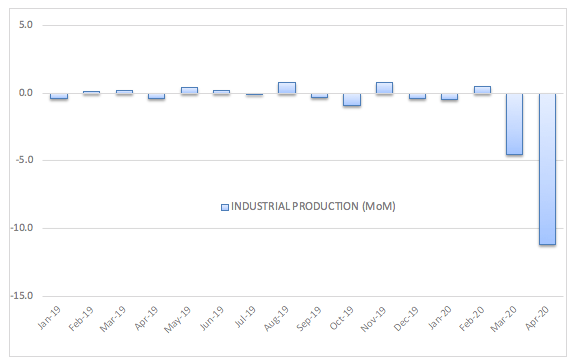

On the not-so-negative side, US Industrial Production contracted at a monthly 11.2% during the same period (vs. a forecasted 11.5% contraction), capacity Utilization shrunk less than estimated to 64.9% and the NY Empire State index bounced to -48.5 for the current month (from April’s -78.2).

Later in the docket, the preliminary print of the Consumer Sentiment for the current month will close the weekly calendar.

What to look for around EUR

EUR/USD is trying hardly to close the week in the positive territory and above the 1.0800 mark. Poor results in domestic fundamentals have been showing the initial effects of the coronavirus crisis in the region’s economy, although these were largely anticipated by market participants and thus mitigated somewhat the impact on the currency. In the meantime, the solid position of the euro area’s current account coupled with the gradual re-opening of the economy keep a deeper pullback in the pair somewhat contained for the time being.

EUR/USD levels to watch

At the moment, the pair is gaining 0.36% at 1.0843 and a break above 1.0896 (weekly high May 13) would target 1.0940 (55-day SMA) en route to 1.1019 (monthly high May 1). On the other hand, immediate contention emerges at 1.0774 (weekly low May 14) seconded by 1.0727 (monthly low Apr.24) and finally 1.0635 (2020 low Mar.23).