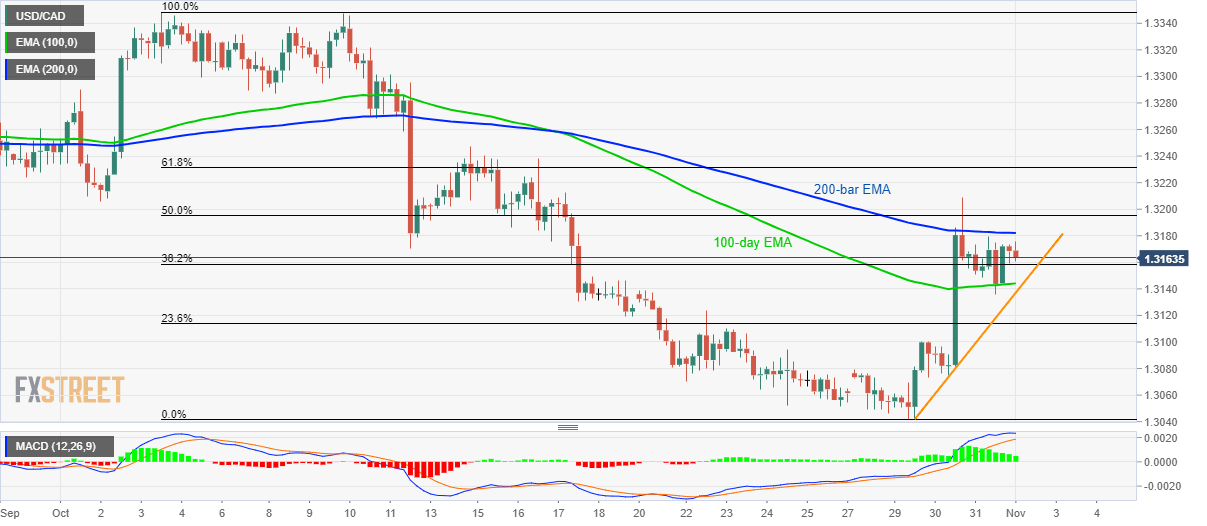

USD/CAD technical analysis: Choppy between 100/200-bar EMA

- USD/CAD fails to defy the key short-term EMAs.

- Sustained trading beyond a three-day-old support line, bullish MACD favors pair’s upside.

Despite pulling back from 1.3200, USD/CAD didn’t slip below 100-bar EMA, which in turn helps it flash 1.3165 number during early Friday in Asia.

Prices are chopped between the 100 and 200-bar Exponential Moving Average (EMA) levels of 1.3144 and 1.3182 respectively. However, buyers are hopeful because the quote stays above a three-day-old rising trend line, at 1.3137 now.

Also increasing the likelihood of pair’s increase is a bullish signal from 12-bar Moving Average Convergence and Divergence (MACD).

As a result, buyers can again challenge Wednesday’s high of 1.3209 on the break of 200-bar EMA level of 1.3182 while also keeping an eye over mid-October tops near 1.3250 during further advances.

Alternatively, pair’s declines below 1.3137 support line could recall 1.3100 and the previous month low close to 1.3040 ahead of highlighting 1.3000 for bears.

USD/CAD 4-hour chart

Trend: sideways