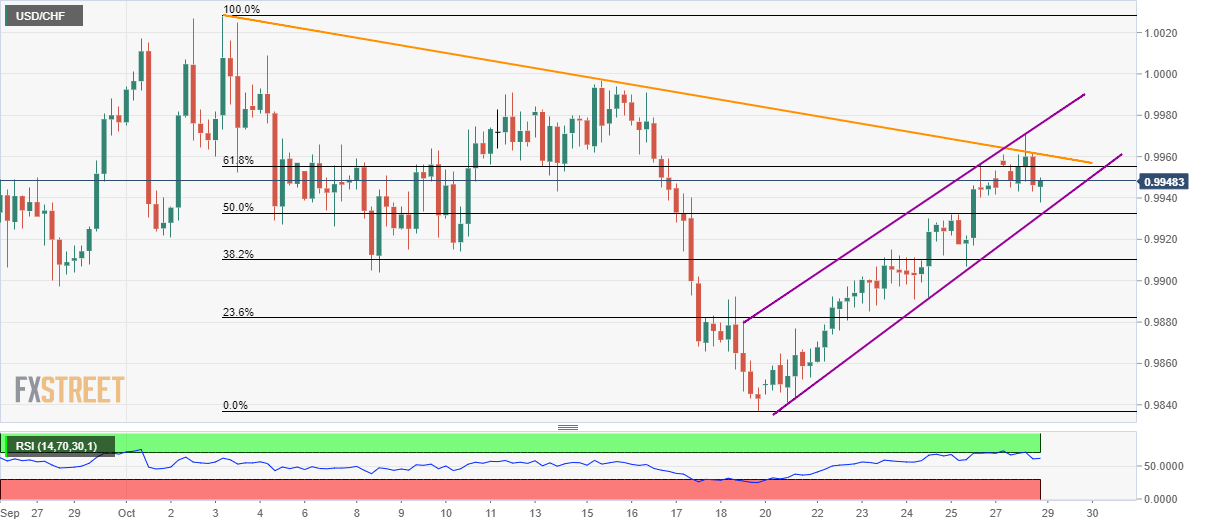

USD/CHF technical analysis: Downside capped by immediate rising channel

- USD/CHF pulls back from multi-day old falling trend line resistance.

- 50% of Fibonacci retracement adds strength to the channel’s support.

Although a downward sloping trend line since October 03 recently triggered the USD/CHF pair’s pullback, prices still stay inside a short-term rising channel while taking rounds to 0.9950 during Asian session on Tuesday.

Not only the lower line of the seven-day-old ascending channel but 50% Fibonacci retracement level of current month declines also highlights the importance of 0.9933/30 as the key support.

On the upside, 61.8% Fibonacci retracement level of 0.9956 can be considered as an immediate resistance ahead of looking back to the descending trend line, around 0.9962.

It’s worth pointing that the pair’s rise past-0.9962 enables it to question mid-month top near 1.0000 while targeting a monthly high of 1.0028.

Alternatively, pair’s declines below 0.9930 set the tone for an extended downpour towards 0.9890 and a monthly bottom close to 0.9835.

USD/CHF 4-hour chart

Trend: further recovery expected