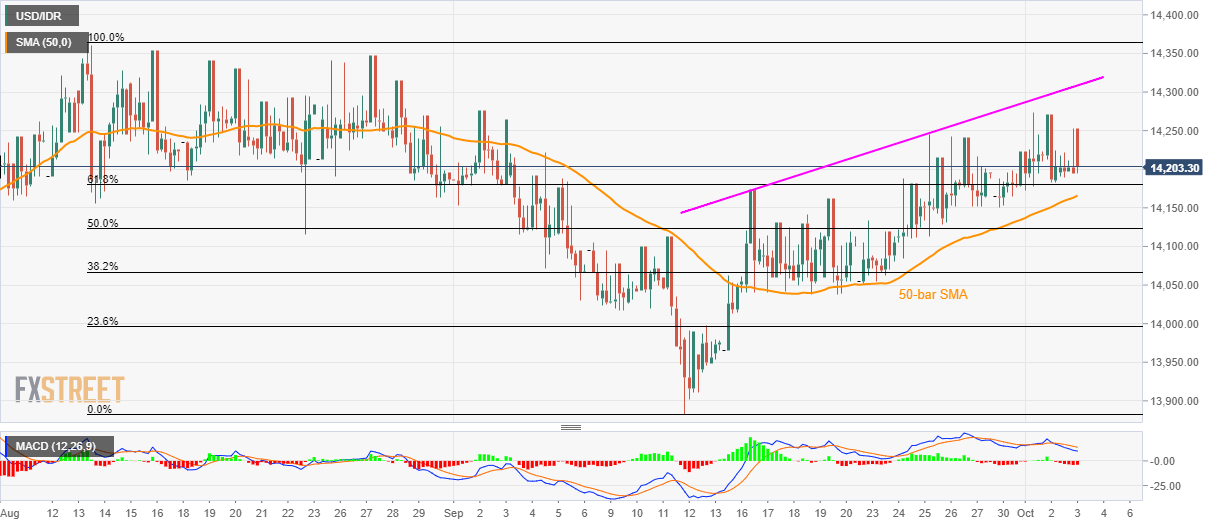

USD/IDR technical analysis: 61.8% Fibo, 50-bar SMA challenge bearish MACD

- The USD/IDR pair stays above near-term key supports despite the latest pullback.

- A two-week-old rising trend-line holds the key to mid-August highs.

Irrespective of the bearish MACD-backed retracement, USD/IDR remains above near-term key supports while trading near 14,200 amid Asian session on Thursday.

In doing so, buyers are hopeful to confront two-week-old rising trend-line, near 14,310, in order to aim for mid-August tops nearing 14,360.

Alternatively, 61.8% Fibonacci retracement of August-September declines, at 14,180, and 50-bar simple moving average (SMA) near 14,165, can keep limiting the pair’s immediate downside despite the bearish signal by 12-bar moving average convergence and divergence (MACD) indicator.

However, pair’s dip beneath 14,165 opens the gate for extended south-run to 14,000-13,995 area including 23.6% Fibonacci retracement whereas September month low close to 13,880 could please bears afterward.

USD/IDR 4-hour chart

Trend: bullish