Back

10 Sep 2019

EUR/USD technical analysis: Euro flatlined below the 1.1073 resistance ahead of ECB on Thursday

- EUR/USD is trading in the 1.1020/1.1073 range ahead of the European Central Bank (ECB) meeting on Thursday.

- The key level to beat for bears is the 1.1020 support level.

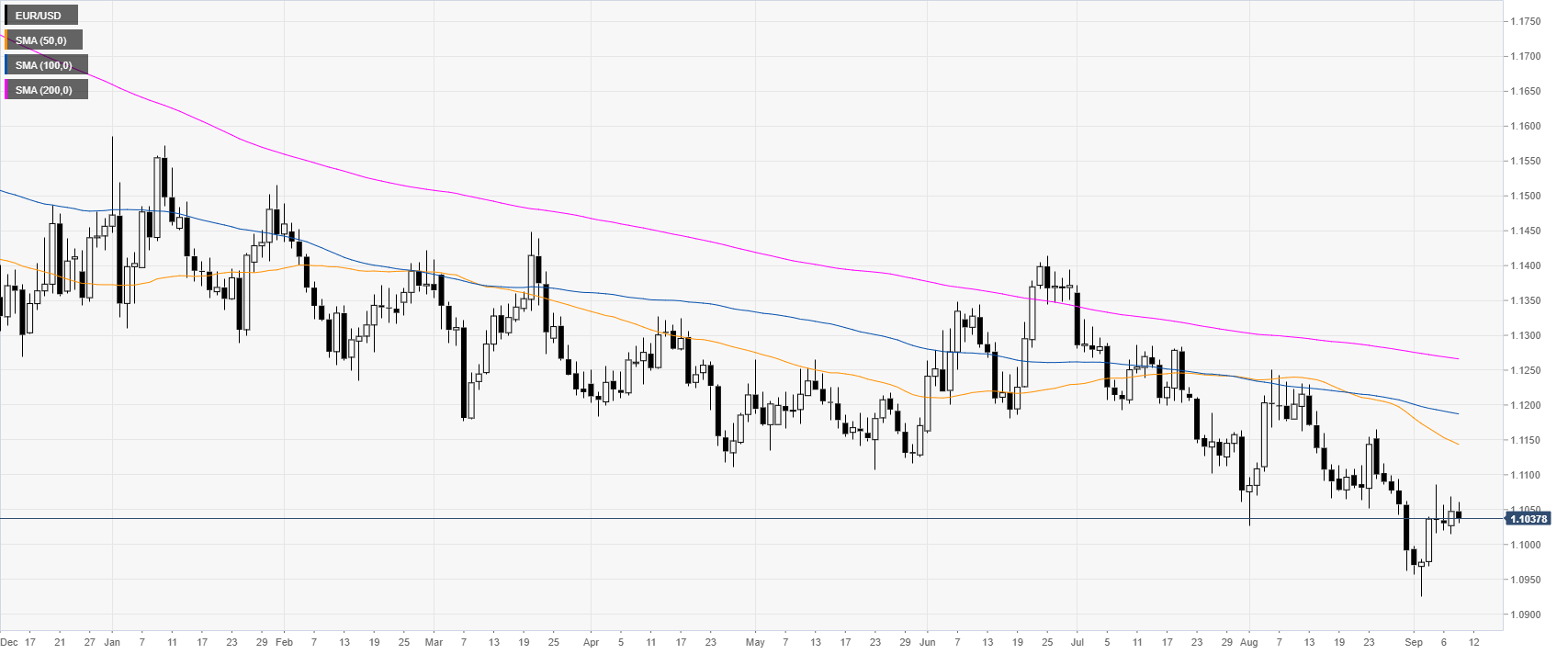

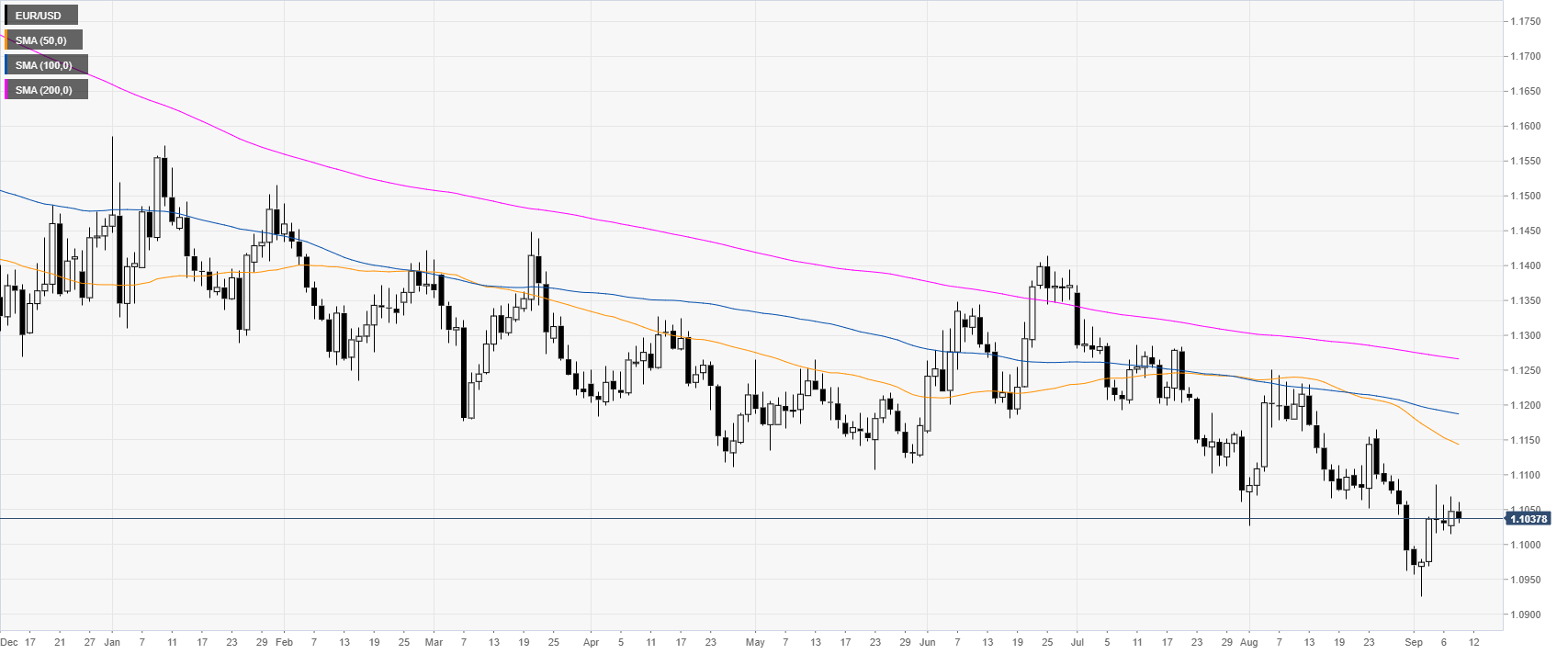

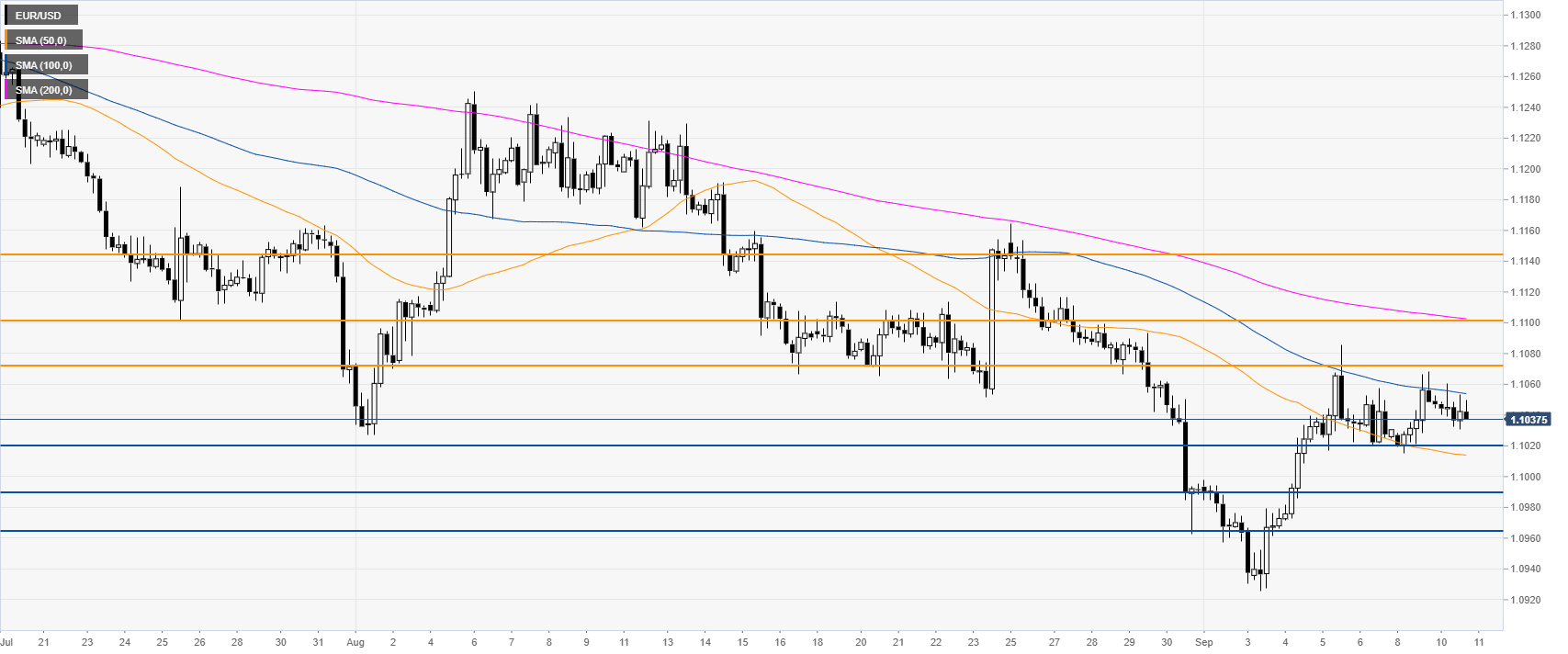

EUR/USD daily chart

On the daily time-frame, the common currency is trading in a bear trend below its main daily simple moving averages (DSMAs). The market is consolidating for its fourth consecutive day ahead of Thursday’s European Central Bank (ECB) meeting.

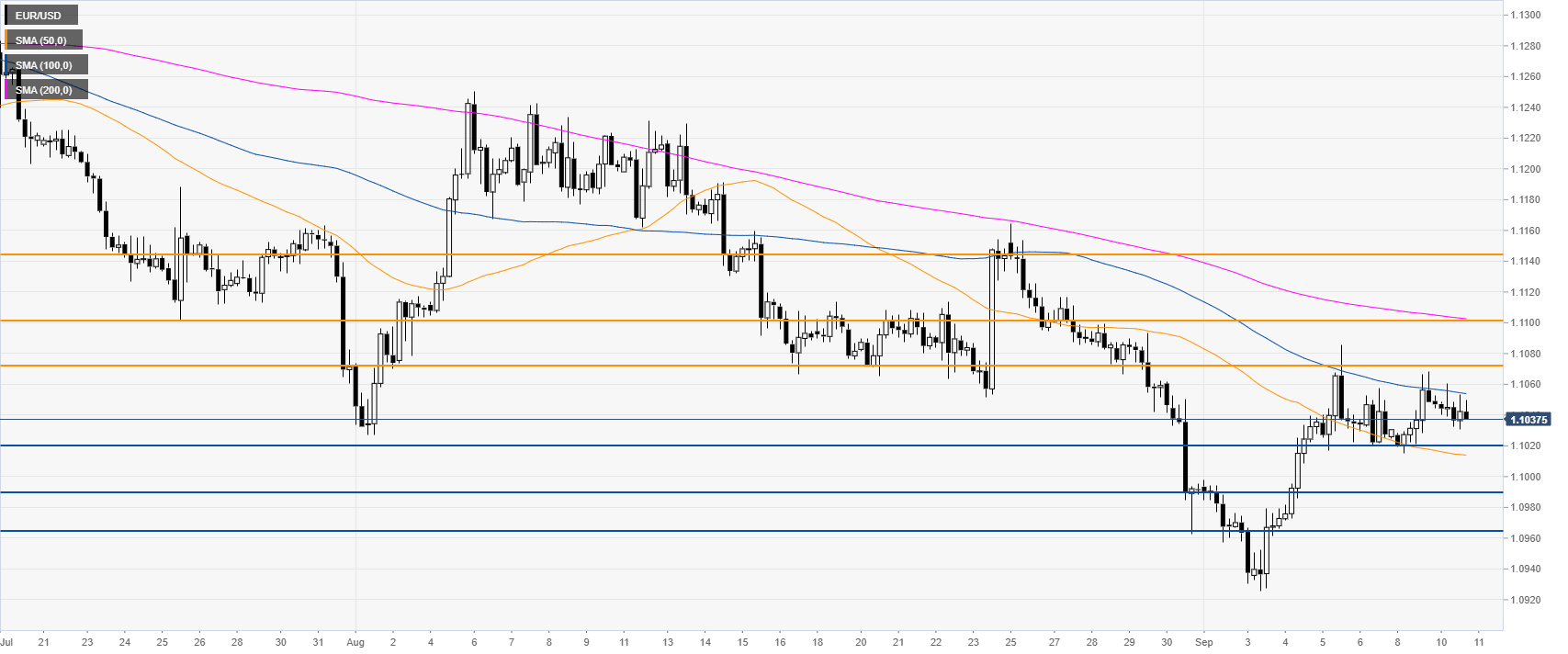

EUR/USD four-hour chart

EUR/USD keeps consolidating last week’s run-up in the 1.1020/1.1073 range. The Fiber is trading below the downward sloping 100 and 200 SMAs, suggesting bearish momentum in the medium term. Sellers will be looking for a break below 1.1020 support to potentially drive the market towards 1.0990 and 1.0964 price levels, according to the Technical Confluences Indicator.

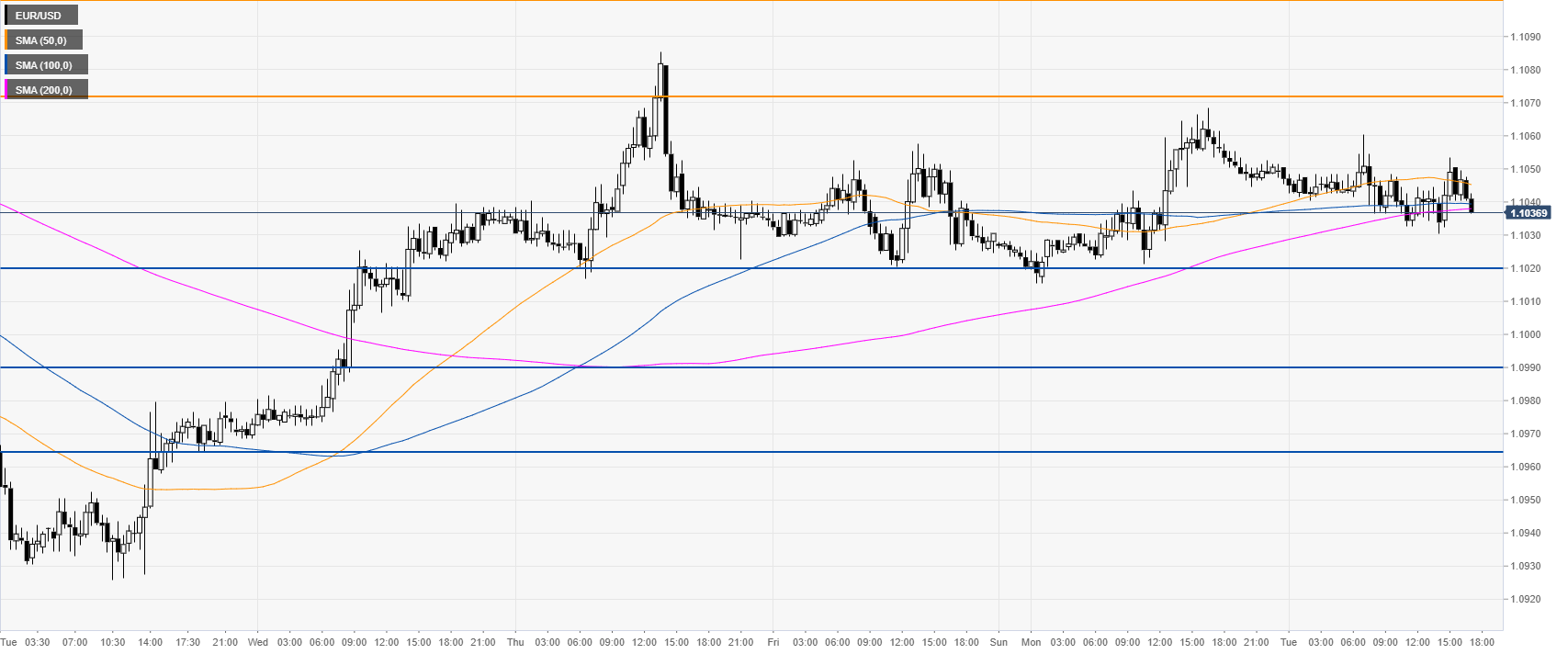

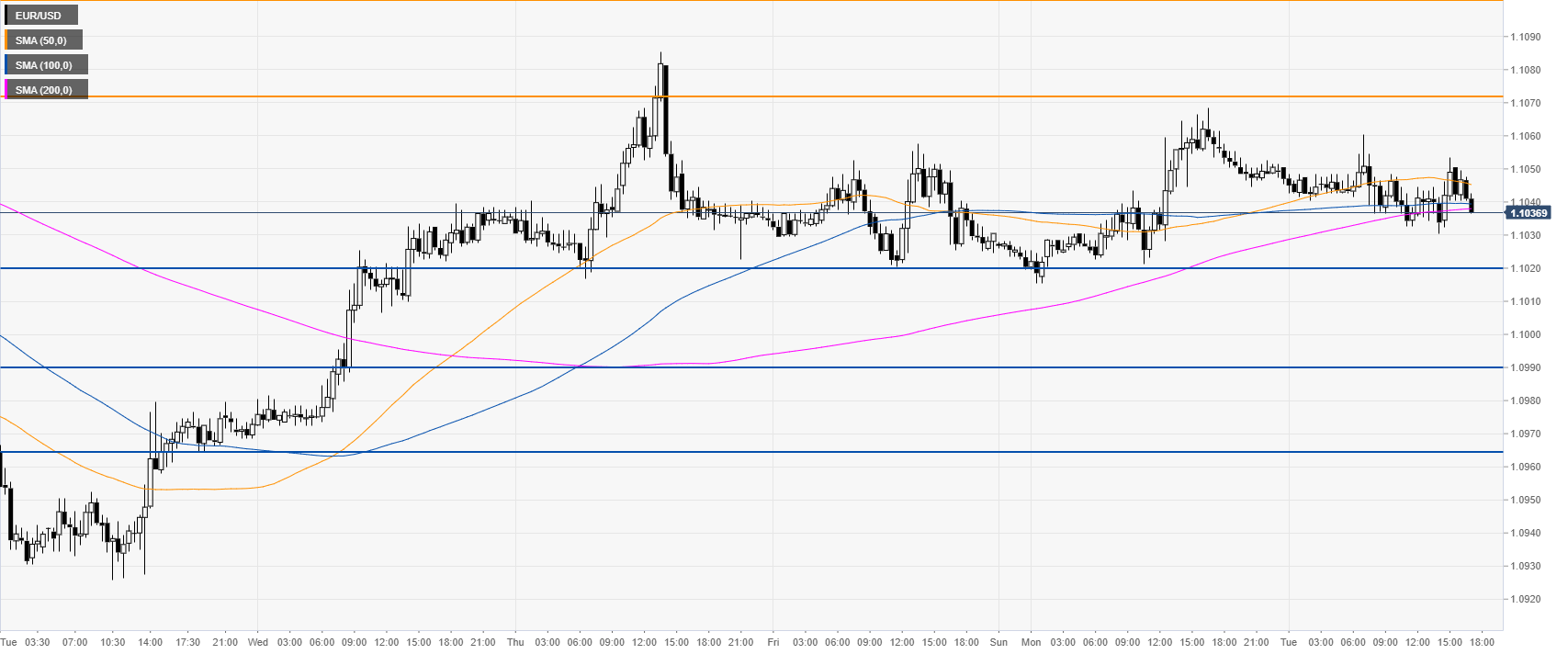

EUR/USD 30-minute chart

EUR/USD is trading in a tight range as it has spent most of the day between its SMAs. All-in-all suggesting a sideways market in the short term. Buyers would likely need a daily close above 1.1073 to attract further buying interest.

Additional key levels