GBP/JPY Technical Analysis: In consolidation just south of 145.00

- The GBP/JPY pair slipped below the 145.00 level yesterday, dropping from intraday highs in the 145.50 region.

- Brexit concerns have largely dominated the GBP's market flows, and Sterling traders are seeing increasing concerns about the longevity of PM May's current Brexit deal, which faces a tough vote in the UK's House of Commons on December 11th.

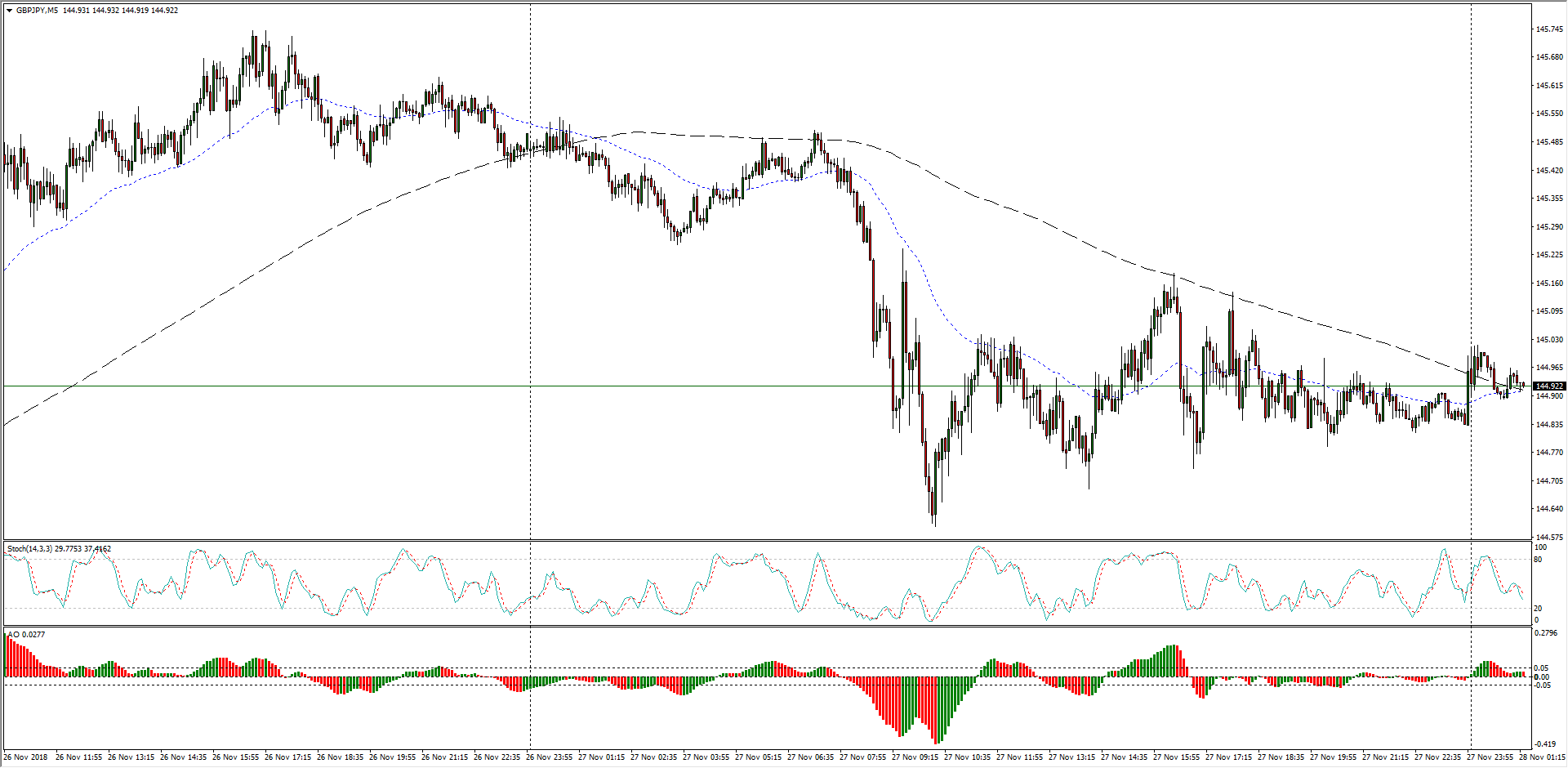

GBP/JPY Chart, 5-Minute

- The Guppy continues to get stuck in a near-term sideways pattern after a stiff drop a couple of weeks ago, slipping loose from the 148.00 handle, and the GBP/JPY has been skidding across the floor between 144.00 and 145.00 for almost two straight trading weeks.

GBP/JPY Chart, 30-Minute

- The last two months have seen the Guppy locked into a rough ranging pattern, and deviations from the 200-period moving average have reverted to the mean indicator, though spending more time towards the downside is seeing the major trend indicator begin to roll over into a bearish lean, and medium-term traders will be looking a fresh bull-run to the 147.00 region or higher before punching in more short-side positions.

GBP/JPY Chart, 4-Hour

GBP/JPY

Overview:

Today Last Price: 144.93

Today Daily change: -64 pips

Today Daily change %: -0.440%

Today Daily Open: 145.57

Trends:

Previous Daily SMA20: 146.16

Previous Daily SMA50: 146.88

Previous Daily SMA100: 145.76

Previous Daily SMA200: 147.05

Levels:

Previous Daily High: 145.76

Previous Daily Low: 144.65

Previous Weekly High: 145.96

Previous Weekly Low: 144.01

Previous Monthly High: 149.52

Previous Monthly Low: 142.78

Previous Daily Fibonacci 38.2%: 145.33

Previous Daily Fibonacci 61.8%: 145.07

Previous Daily Pivot Point S1: 144.9

Previous Daily Pivot Point S2: 144.22

Previous Daily Pivot Point S3: 143.79

Previous Daily Pivot Point R1: 146

Previous Daily Pivot Point R2: 146.43

Previous Daily Pivot Point R3: 147.11