When is the US CPI and how could it affect EUR/USD?

US July CPI Overview

Today's US economic docket highlights the release of latest consumer inflation data and is due for release later during the early North-American session, at 1230GMT. The headline CPI is expected to have risen by 0.2% m/m in July, with the yearly rate ticking higher to 3.0% from the previous month's reading of 2.9%. Meanwhile, core CPI, which excludes volatile food and energy prices, is also expected to have risen by 0.2% m/m and the yearly rate is anticipated to hold steady at 2.3%.

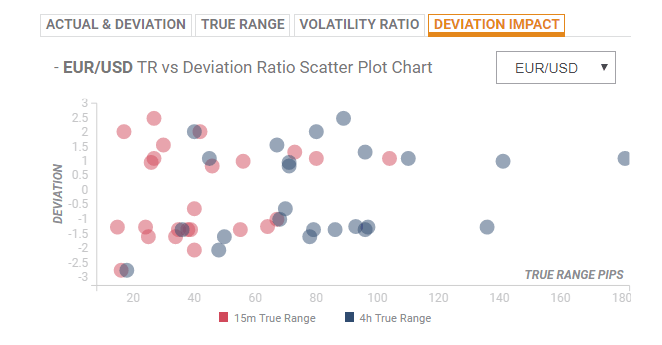

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below and as observed, the reaction in case of a relative deviation of +0.98 to -1.25 in the core CPI print is likely to be in the range of 24-26 pips during the first 15-minutes and could stretch to around 68-71 pips in the following 4-hours.

How could it affect EUR/USD?

Yohay Elam, FXStreet's own Analyst explains, “the pair has some support at 1.1440 which is the convergence of the Pivot Point one'week Support 2 and the Fibonacci 161.8%. Further down, 1.1370 is the Pivot Point one-month Support 3 which could provide some support. Even lower, we find 1.1321 which is the Pivot Point one-week Support 3.”

“Looking up, the former 2018 trough of 1.1508 is also the confluence of the PP one-week Support 1, the PP one-day S1, and the Bolinger Band one-hour Lower. 1.1530 is the congestion of the BB 4h-Lower, the one-day, the Simple Moving Average 10-one-hour, and the SMA 5-one-hour,” he adds further.

Key Notes

• US: YoY rate for core CPI inflation likely to be 2.32% - Deutsche Bank

• How to trade the US Inflation data with EUR/USD

• EUR futures: door open for extra downside

About the US CPI

The Consumer Price Index released by the US Bureau of Labor Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).