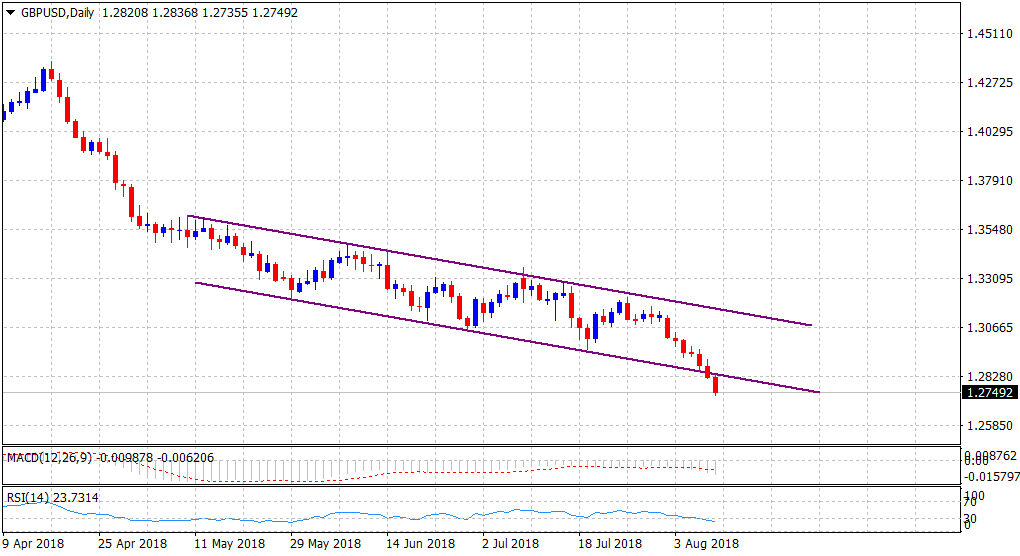

GBP/USD Technical Analysis: Clocks 13-month low, below mid-1.2700s ahead of UK macro data

• Bears dragged the pair below a short-term descending trend-channel in the overnight trading session and the selling pressure remains unabated for the seventh consecutive session on Friday.

• The ongoing USD upsurge further set off the bearish tone through the early European session and ahead of important UK macroeconomic releases, including the prelim Q2 GDP growth figures.

• A break below the August 2017 low now opens the room for an extension of the well-established bearish trend, albeit near-term oversold conditions might help limit losses, for the time being.

GBP/USD daily chart

Spot Rate: 1.2749

Daily High: 1.2837

Trend: Bearish, though oversold conditions warrant some near-term consolidation

Resistance

R1: 1.2800 (round figure mark)

R2: 1.2835-40 (trend-channel support break-point)

R3: 1.2884 (R1 daily pivot-point)

Support

S1: 1.2729 (S3 weekly pivot-point)

S2: 1.2700 (round figure mark)

S3: 1.2675 (horizontal zone)