Gold supported by dovish hike and tariffs on China

- The Fed dovish hike is weighing on the USD.

- Trump should announce tariffs on China this Thursday.

Gold is trading at around the 1330 mark, virtually unchanged so far on the day. On Wednesday the Fed failed to surprise the market. As a matter of fact, the market was surprised to see only two more rate hikes in 2018 as opposed to three. The market reaction was one-sided across the board: sell USD.

The Fed did raise the target range for the federal funds rate by 25 basis points to 1.50%-1.75% as it was widely anticipated. Although the Fed was optimistic about the economic outlook by adding one more rate hike for 2019-2020, the Fed remained dovishly cautious by only announcing two rates hike in 2018 as already mentioned above.

Adding pressure to the US dollar is Donald Trump which said he is getting ready to impose tariffs on Chinese products worth around $60 billion. The protectionists' measures are broadly seen as US dollar negative. The Chinese tariffs should be officialized this Thursday. Mr. Trump says the objective is to “curb theft of US technology”. China said they would respond by implementing tariffs as well, therefore increasing the odds of a global trade war.

Earlier in the US session Continuing jobless claim came a little better than expected while initial jobless claims in March disappointed.

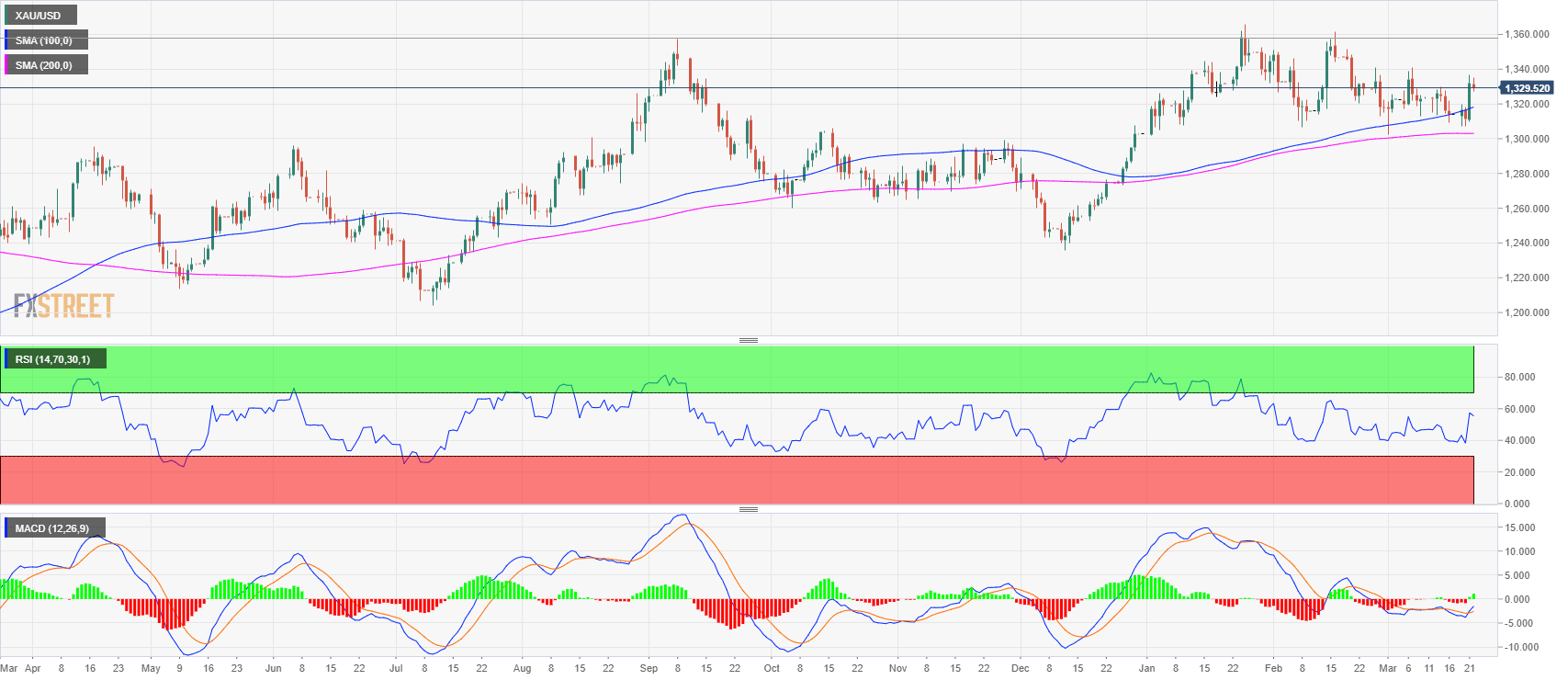

Gold daily chart

Gold had a bull breakout on the FOMC announcement and since then it is consolidating around the 1330 psychological mark. As mentioned yesterday, the bull trend is still intact as market participants are likely digesting the events of yesterday with the FOMC.

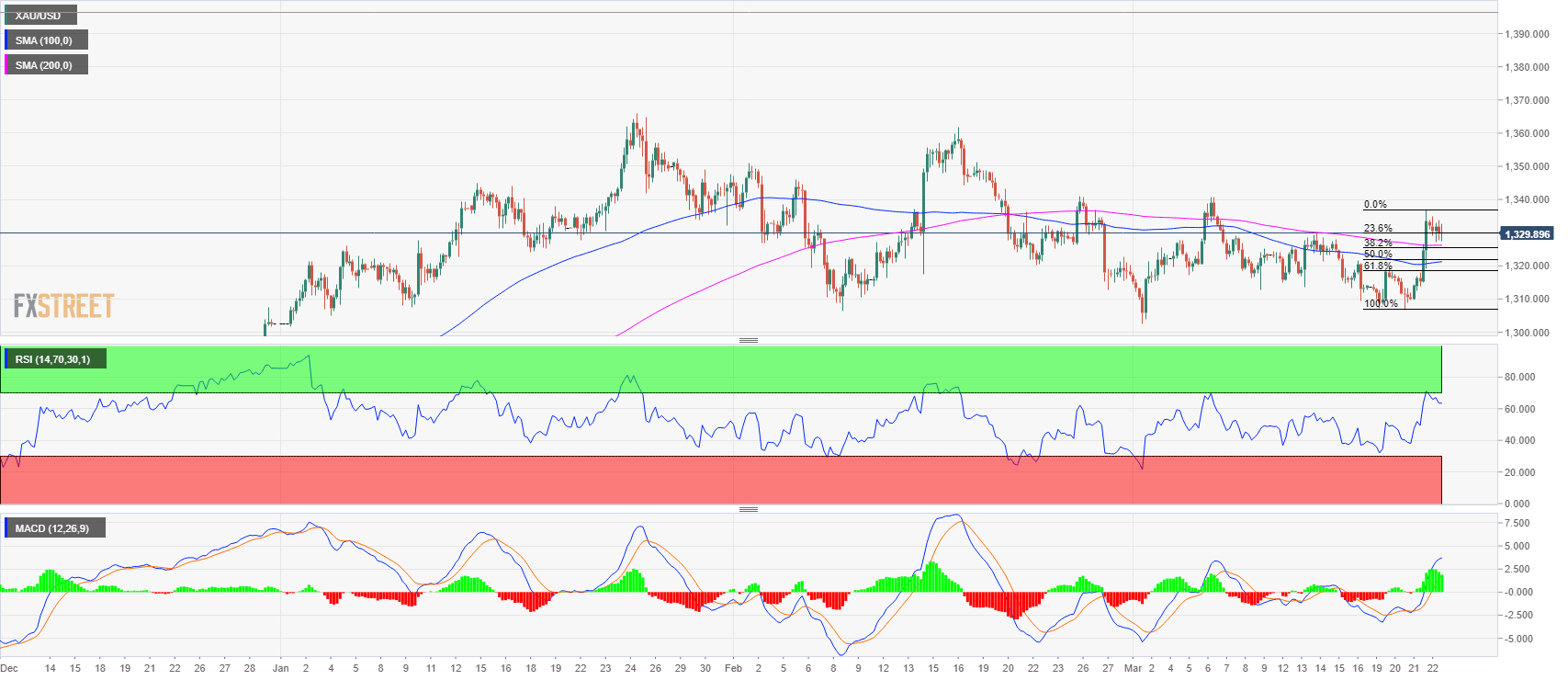

Gold 4-hour chart

The bulls broke above both the 100 and 200-period simple moving averages. The market is having a small pullback to the 200-period SMA coiling around the 23% Fibonacci retracement from the last bull leg. So far the pullback looks healthy for bulls as bears are not displaying aggressive attacks so far. However, traders have to keep in mind that the DXY has found some support in the EU session and is grinding higher on the day. Intraday support on Gold is seen at 1325 with the 100 SMA and at 1319 which is the 61.8% Fibo. To the upside, resistance is seen at 1337 high of the day. If that level is taken out, it would likely open the gates to higher prices seen in the 1360.00 region, the previous high for the year.It looks like Gold prices are mainly dictated by what the USD does.