CAD/JPY: support at 0.7270 ahead of SNB rates on Thursday

- Swiss National Bank interest rate decision is set on Thursday at 8.30GMT.

- Canadian ADP employment change is set on Thursday at 12.30 GMT.

The CAD/JPY is trading at about 0.7295 virtually unchanged on the day after finding a low at 0.7270 about 24 hours ago.

The recent wave of selling seen in the CAD is likely a market overreaction according to analysts as interest rates in Canada are still meant to 'mover higher over time' as Poloz put it. In recent comments, he said that the economy "was still operating in line with the January MPR forecast."

Data for Canada coming up next is the ADP employment change on Thursday at 12.30 GMT.

Thursday at 8.30 GMT will see the Swiss National Bank's interest rates decision and quarterly bulletin. According to analysts at Nomura, the SNB is not likely to hike in the near future as inflation is just not there yet. Read the SNB article here.

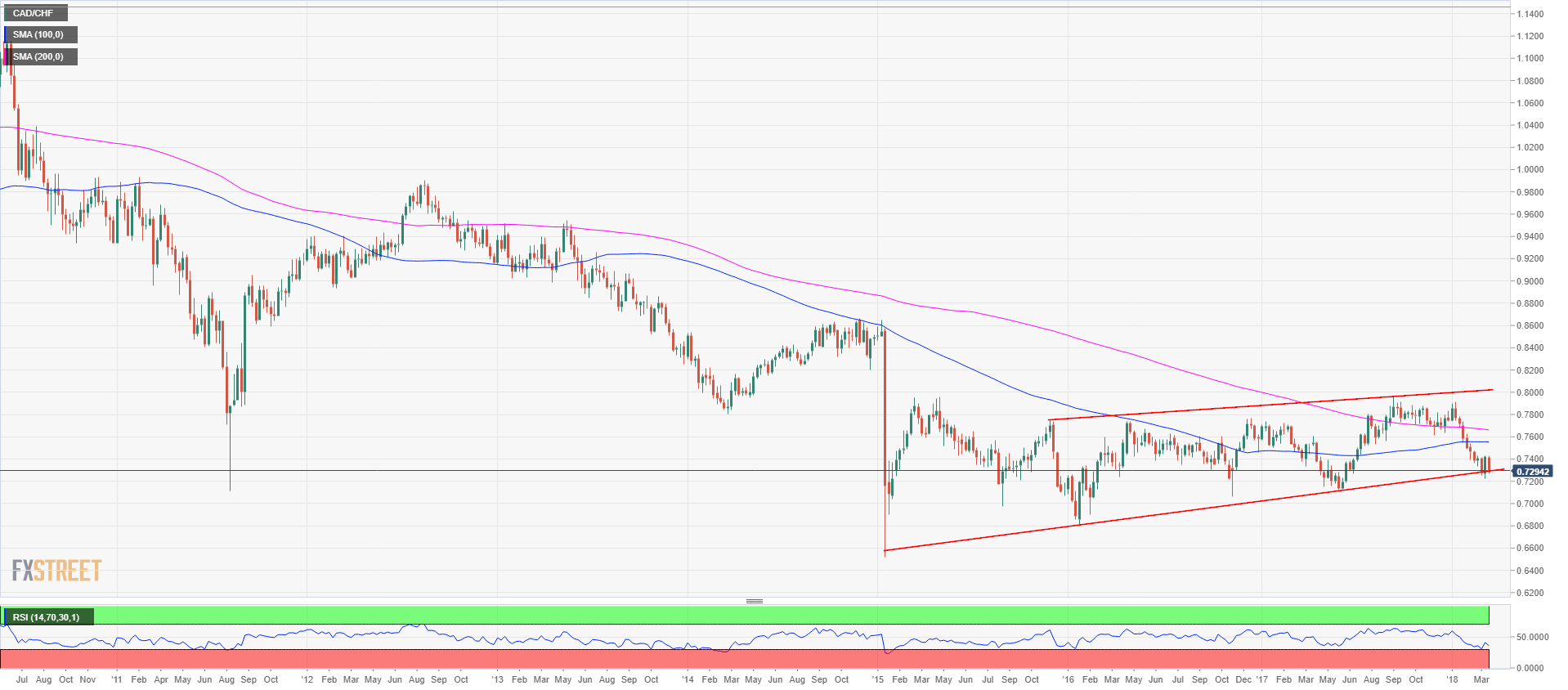

CAD/CHF weekly chart

Looking at the monetary policy divergence the CAD/CHF is likely poised to appreciate in the near future while investors are likely trying to grab a deal in the lower part of the channel as seen in the weekly chart above.

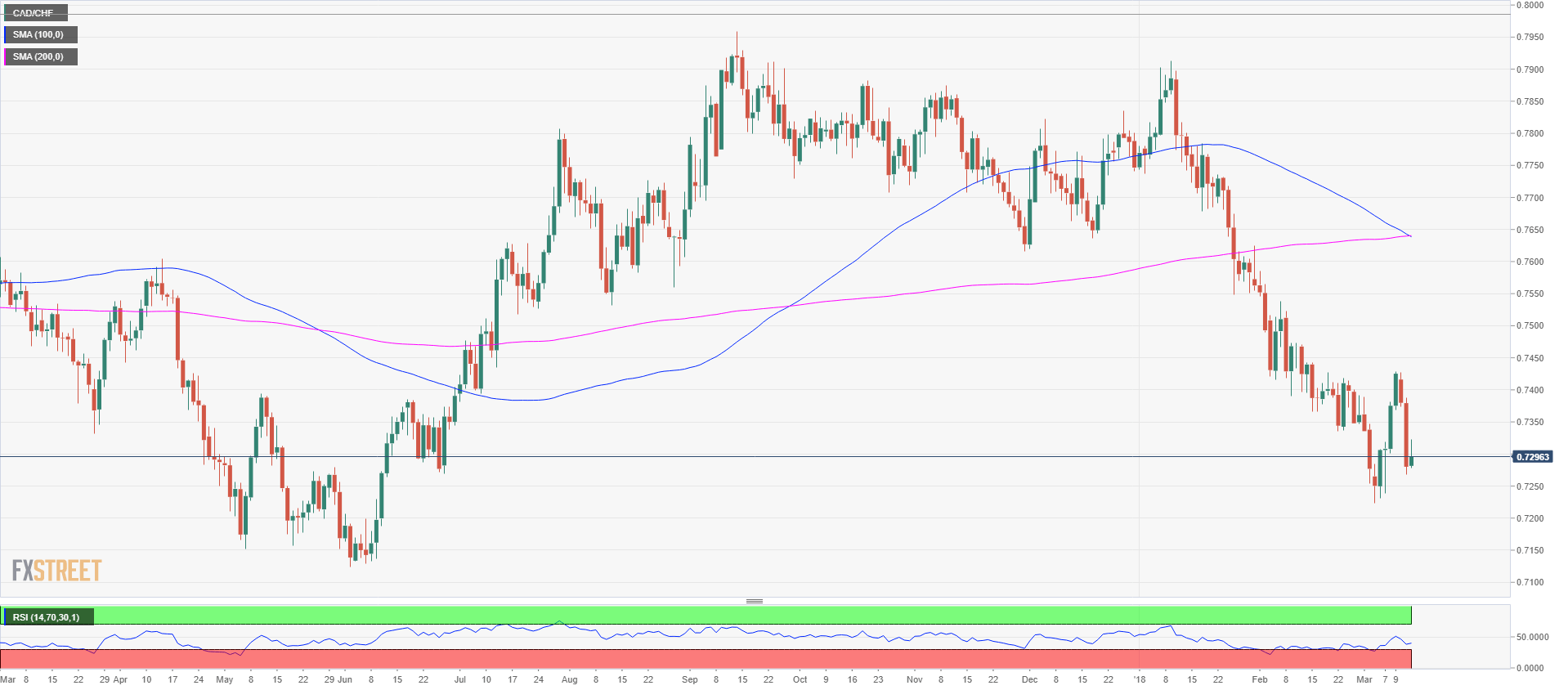

CAD/CHF daily chart

Traders tried hard to make the CAD/CHF rally last week and brought the pair to 0.7430 in a strong impulsive move, however, sellers have managed the bring the market down below the 61.8% Fibonacci retracement making it a deep correction. Now bulls will try hard to defend the 0.7250 level and create a double bottom in the process. If they fail 0.7150 is likely going to be the next support level as it was a previous demand zone. Resistance is seen at the 0.7350 psychological level and the 0.7430 high of last week.