USD/JPY remains confined in a tight range above 111

On Monday, the USD/JPY pair is moving sideways in a tight channel above 111. At the moment the pair at 111.18, up +0.8% on the day having posted a daily high at 111.58 and a low at 111.11.

Although the greenback started to lose strength in the early trading hours of the American session, the increasing risk appetite reflected by the performance of the US stocks is making it hard for the JPY to find demand, hence leaving the pair ambivalent.

As of writing, the US Dollar index is at 100.94, losing 0.15% on the day. Today's data showed that the Fed’s Labor Market Conditions Index fell to 0.4 in March from 1.5 in February and may have put some added pressure on the greenback. In the meantime, the Dow Jones Industrial Average is gaining 0.36% while the S&P 500 is adding 6.75 points or 0.3%.

The market sentiment could remain as the sole driver of the price action until Fed Chair Yellen crosses the wires later during the session. Yellen will be speaking at the University of Michigan, and it will be interesting for the markets to see what she has to say regarding the balance sheet reduction and its relationship with the rate hike path.

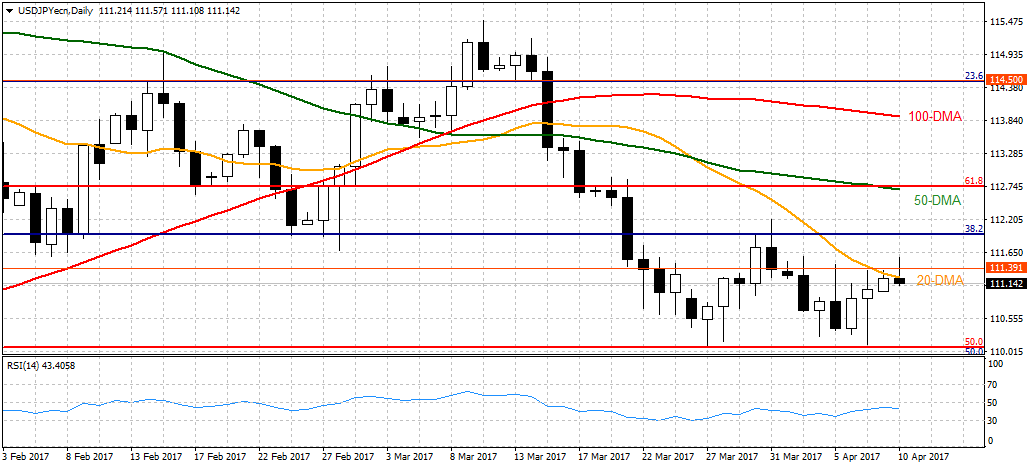

Technical outlook

The pair could encounter the first technical support at 111 (psychological level) before 110.13 (Apr. 7 low) and 109 (psychological level). On the upside, the initial hurdle aligns at 111.25 (20-DMA) followed by 112.20 (Mar. 31 high) and 112.70 (50-DMA).

- USD/JPY: ¥111±3 range for now – Deutsche Bank

- USDJPY: Significant support around 110 levels - BBH