EUR/USD Price Analysis: Bulls come up for air and eye a break of trendline resistance

- EUR/USD bears could be throwing in the towel.

- Bulls eye a run to test the 1.08s.

As per the prior analysis, EUR/USD Price Analysis: Bears eye an extension but bulls look to test the 1.0880s, whereby EUR/USD was seen to be attempting to correct the heavy selling that has taken place over the course of several days, the following is playing out:

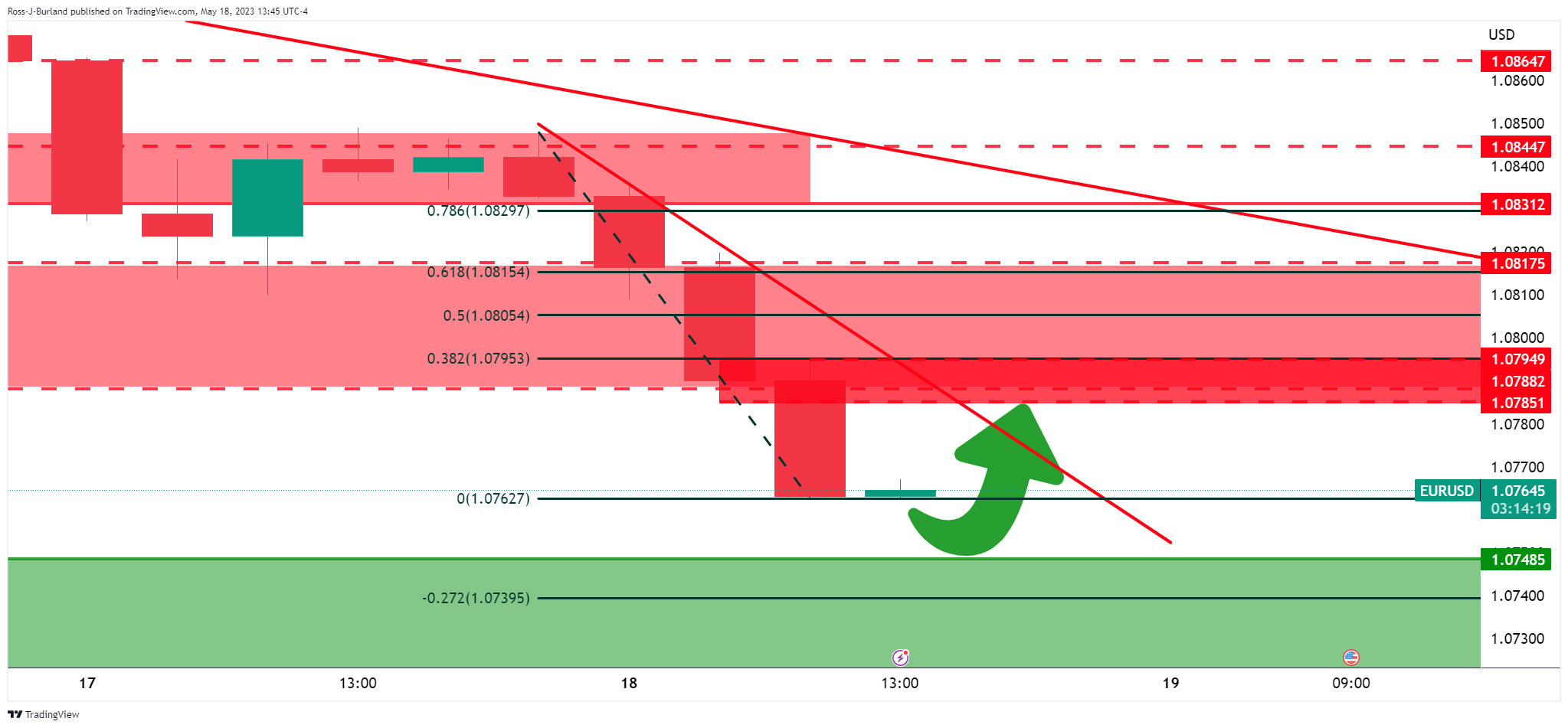

EUR/USD H4 chart, prior analysis

It was stated that the bulls could start to monitor for signs of deceleration and a potential correction.

The 4-hour trendline and horizontal resistance were key in this regard as a failure to break above these would leave the bears in control.

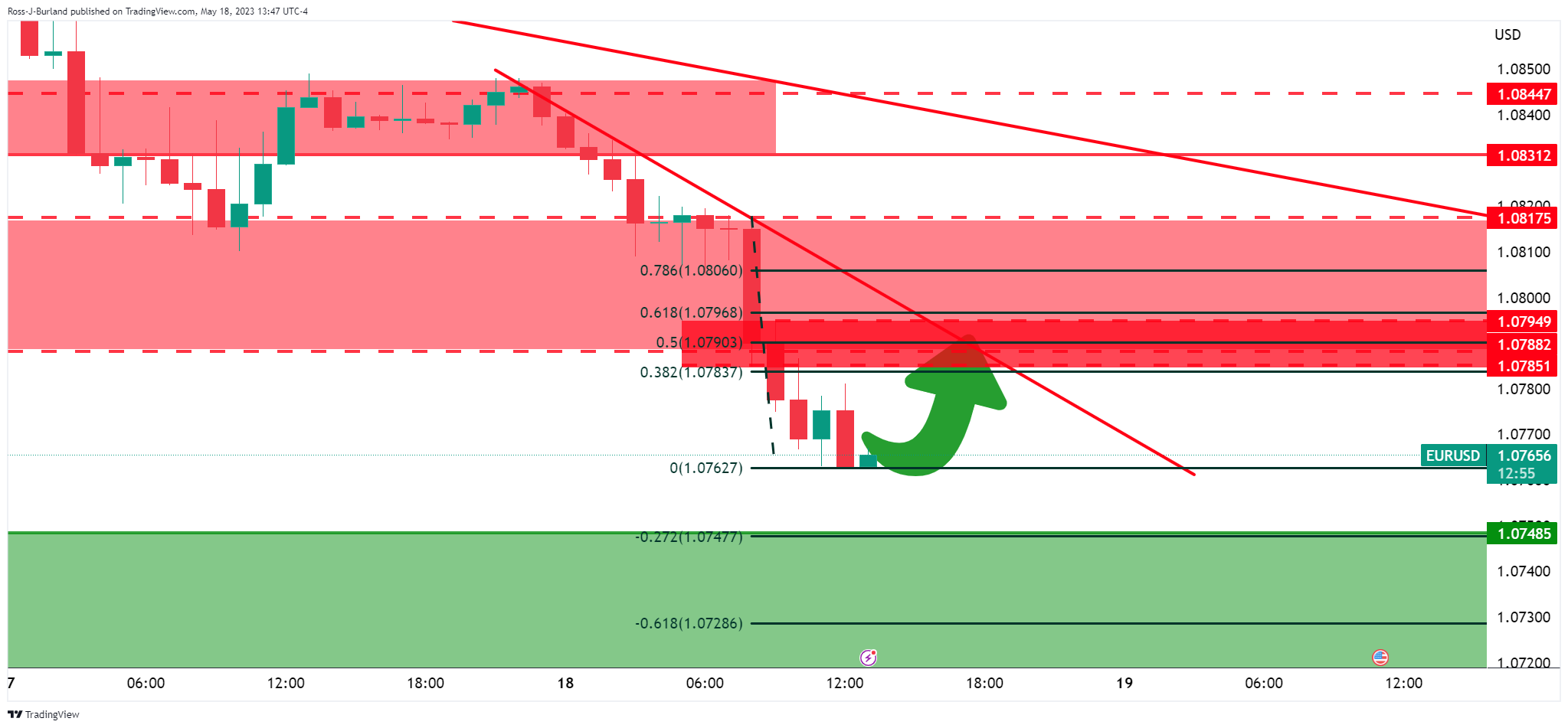

EUR/USD H1 chart, prior analysis

The hourly chart was used to show that if the bulls committed, then there would be prospects of a move to test 1.0780s and 1.0790s and then 1.0800 and the 1.0820s.

EUR/USD live updates

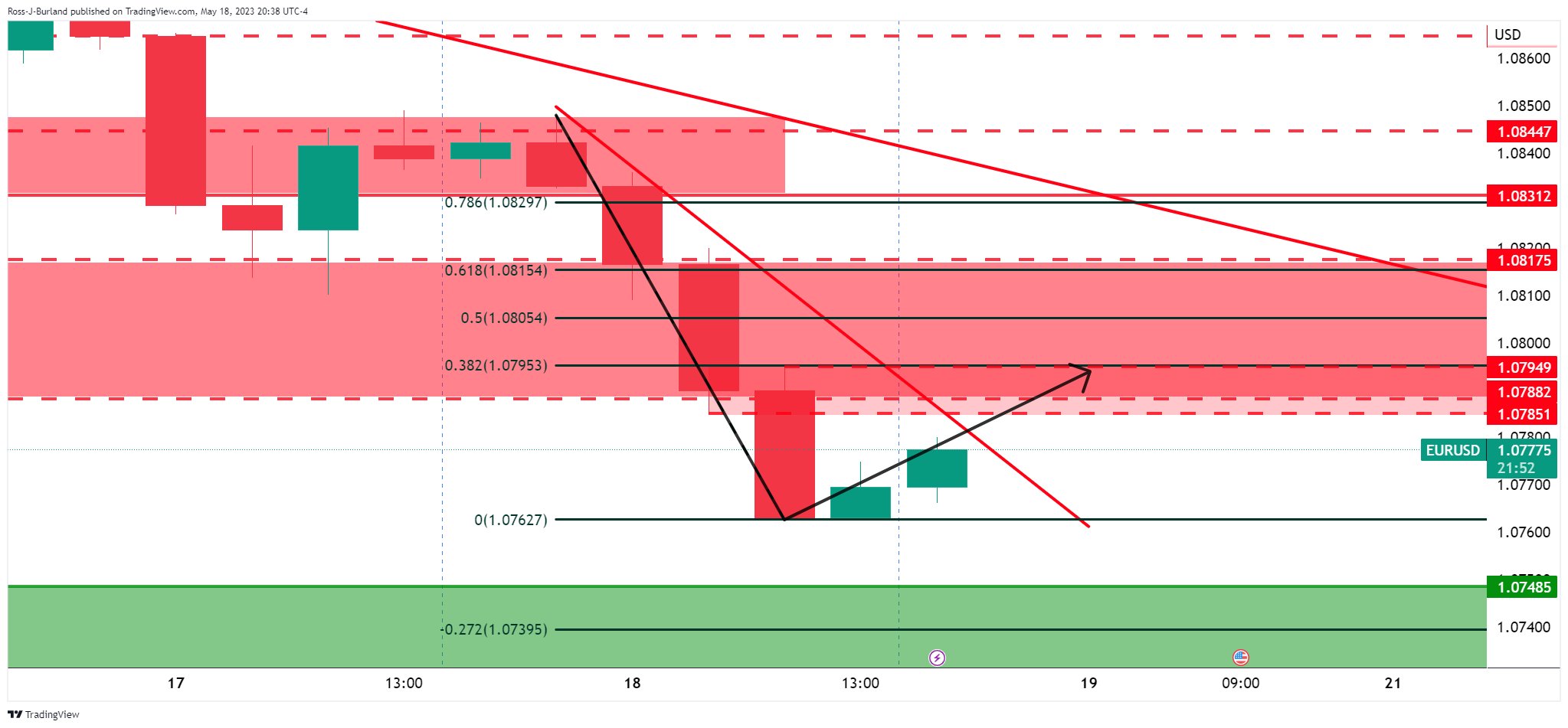

On the 4-hour chart, the current candle is creeping higher toward the trendline resistance.

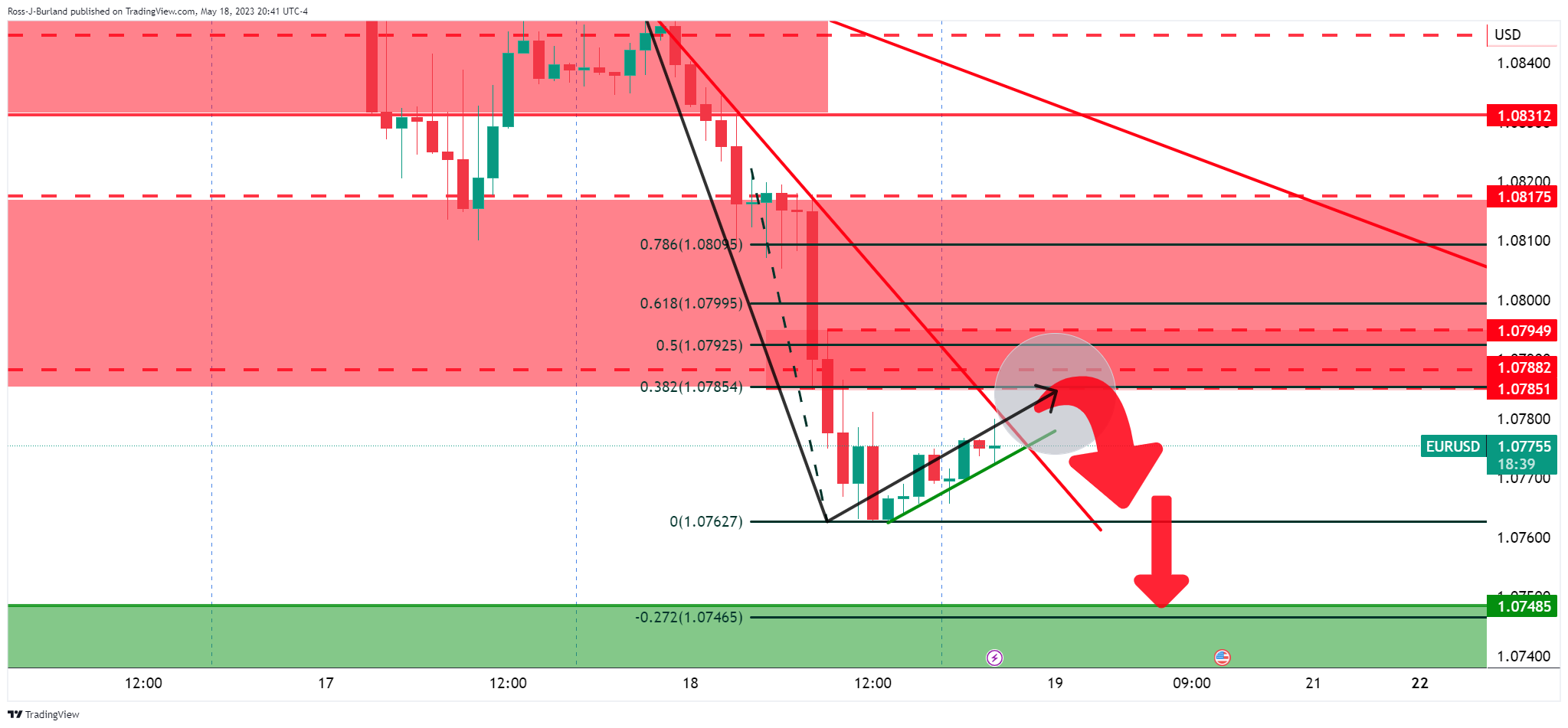

The following hourly charts off a couple of scenarios:

The hourlñy 38.2% Fibonacci in the 1.0780s could act as a resistance area and although the price would be on the backside of the bearish trendline, there will still be scope for a downside extension.

On the other hand, should the bulls commit, then a run toward a test of the bear´s commitments in the 1.08s will be on the cards.