Back

1 Feb 2023

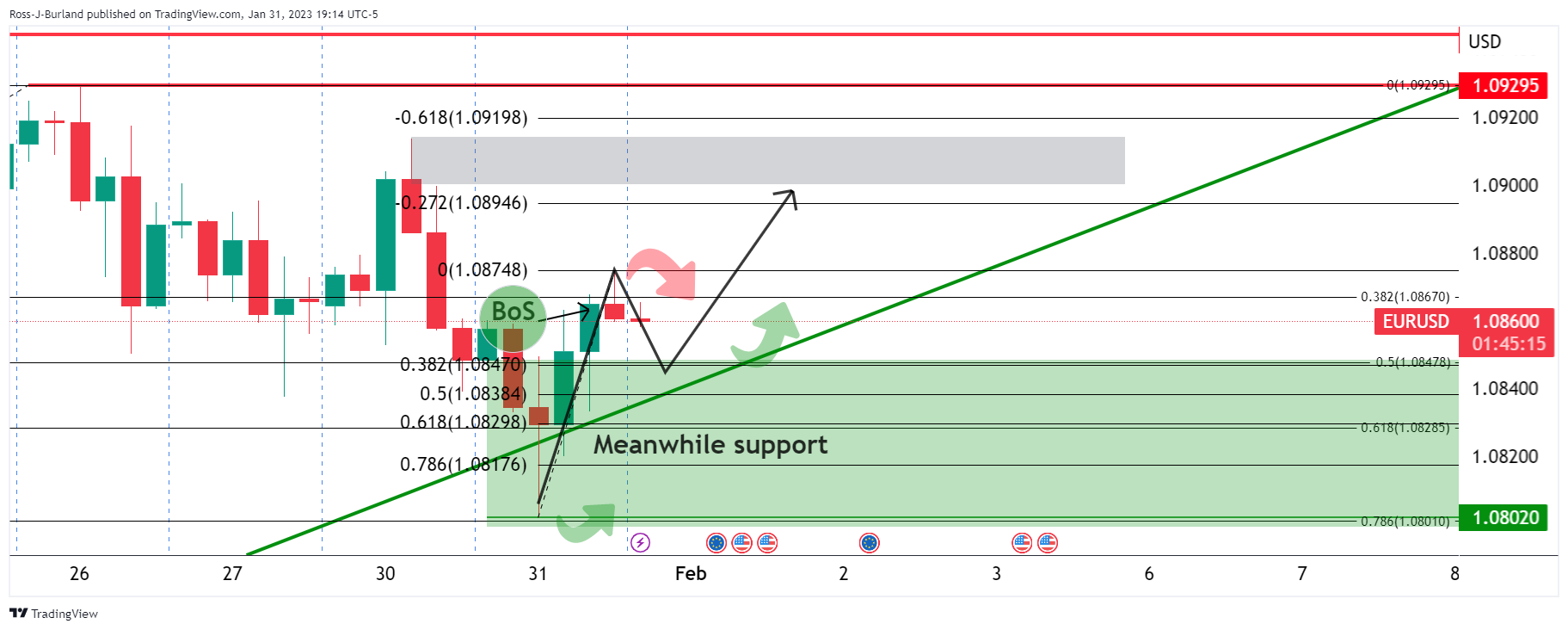

EUR/USD Price Analysis: Bulls eye a move to test 1.0900/20

- EUR/USD bulls remain in play above 1.0850 on the front side of the daily trendline support.

- 1.0900 comes in at the target with 1.0920 above there as a potential liquidity zone.

EUR/USD is at an important juncture on the charts ahead of the Federal Reserve event whereby there are prospects of a significant correction if the market finds itself wrong on the Fed. However, in the meanwhile, a move to test 1.0920 could be on the cards.

EUR/USD daily charts

A break of the bull cycle's trendline support and a hawkish outcome at the Fed would see the price plummet over time for a test all the way down to 1.0650/00.

EUR/USD H4 chart

The price has broken the structure and this leaves the bias to the upside for the sessions ahead of the Federal Reserve. The support comes in near a 38.2% Fibonacci retracement of the prior bullish 4-hour impulse where a correction would be expected to decelerate. This comes in at 1.0850.