What is the SMC in Forex trading

Key concepts of the SMC trading

How does the Smart Money Concept work?

Pros and cons of SMC

How to trade with the SMC

Final thoughts

The Smart Money Concept (SMC) is not just a trading strategy but a fundamental philosophy of market presence. It is based on the desire of market participants to act in unison with big players to increase the chances of being profitable. The Smart Money Concept suits both experienced and novice traders. It is usually preferred by those serious about choosing financial instruments rather than buying currency at random.

What is the SMC in Forex trading?

The Smart Money Concept derives its name from the classical terminology used in financial markets. According to this concept, 'Smart Money' refers to investments made by huge market players, such as hedge funds and pension funds.

The system's inventor is a well-known modern trader, Michael Huddleston; many know him under the nickname 'Inner Circle Trader' or 'ICT'. He is an ardent supporter of conspiracy theories in the market. He is sure that 'Smart Money', acting as the main market maker, is constantly hunting for funds from both small retail traders and larger players who do not participate in determining asset prices. He believes that each trader who understands the actions of Smart Money representatives can make trading decisions in line with them, earning money.

Several videos on Huddleston's blog explain the Smart Money Concept, its terminology, and the application of SMC. Most materials are free, but the trader also provides paid trading education within the SMC framework. By his admission, this has proven to be a great idea since the sums contributed by students have already exceeded his income from trading on the financial markets.

Key concepts of the SMC trading

Here are several provisions of the Smart Money system.

- Bullish and bearish trends, consolidation. To determine trends, traders can use classical methods. In a bull market, highs and lows rise successively. In a bear market, highs and lows fall successively. The overlap of the next low (in a bull market) or the next high (in a bear market) with the previous one is considered a break in the structure and can signify a transition into a period of consolidation (a range).

- Liquidity as a market driver. In this context, participants other than Smart Money are often viewed as liquidity providers. Support and resistance levels can be interpreted as liquidity, where significant buying or selling interest exists. Traders typically place stop orders, such as Buy Stop and Sell Stop, around these support and resistance levels to enter the market during a breakout and stop-loss orders for protection when trading on rebounds, creating zones of liquidity accumulation. Smart Money often targets areas of high liquidity—such as zones around support and resistance levels—where many orders are clustered, using these areas to buy (accumulate) or sell (distribute) large positions without causing significant price movements, particularly in markets that are moving sideways or lack a strong trend.

- Liquidity levels. Marking liquidity levels on all timeframes (TFs) is considered useful and necessary. This includes highlighting the market structure of the senior (higher) TFs to determine the direction of trading on the junior (lower) ones.

- Market gaps. Market gaps, often referred to as 'imbalances' in Smart Money Concepts (SMC), represent areas where price movement creates inefficiencies. For example, a Fair Value Gap (FVG) occurs when there is a noticeable void or imbalance between buying and selling activity on a price chart. These gaps are considered zones of market inefficiency, and there is a principle that such gaps have a high probability of eventually being filled or 'closed' as the market seeks to restore balance.

- Market patterns. The primary way to find a market entry point is to describe several patterns based on bullish and bearish trends, such as Breakout to Update Structure, Breakdown of Structure (BOS), Change of Character (CHoCH), Impulse Shift, and Order Block.

The below section shows some of the price action patterns and market structures in SMC.

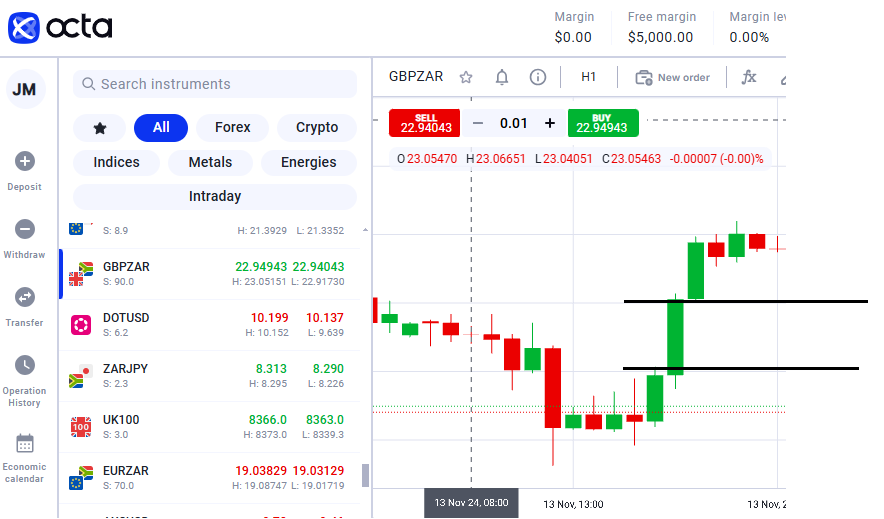

- Break of structure (BOS). This pattern indicates that the current trend will probably continue.

Fair value gaps (FVG). In SMC, this is a gap that is left in the market. It usually indicates an imbalance in price. One presumption of FVG is that the market will retrace back to fill the FVG left. Inversion Fair value gaps (IFVG). These are key areas in the market where the fair value gap is invalidated. In SMC, it indicates a shift in the market's momentum.

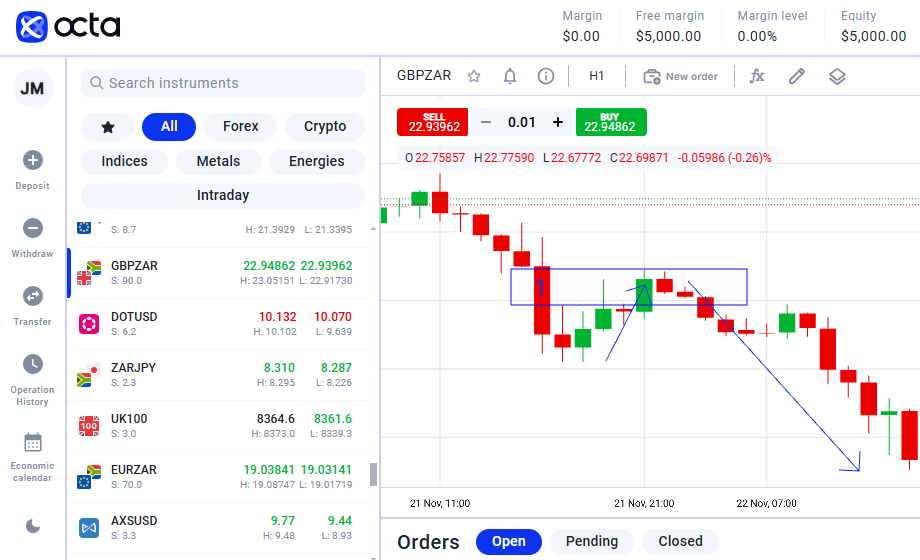

Inversion Fair value gaps (IFVG). These are key areas in the market where the fair value gap is invalidated. In SMC, it indicates a shift in the market's momentum. Change of Character (CHoCH). SMC defines this as a change in the market structure indicating a possibility of the trend losing momentum or reversing.

Change of Character (CHoCH). SMC defines this as a change in the market structure indicating a possibility of the trend losing momentum or reversing.

These are considered the areas where traders have placed their Stop Losses.

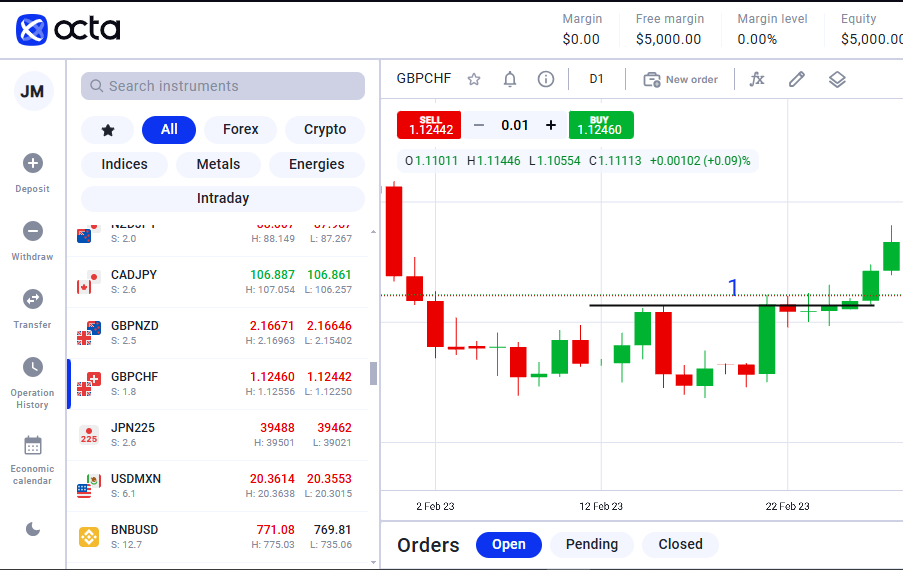

1.Buy Side Liquidity (BSL)

2. Sell Side Liquidity (SSL)

How does the Smart Money Concept work?

Some investors claim the Smart Money strategy is built on classic technical analysis tools. Moreover, it is sometimes suggested that the SMC is a beautifully reworked Price Action strategy. However, most traders believe that the Smart Money Concept is an alternative to traditional methods of technical analysis using digital and financial instruments.

The difference between Michael Huddleston's strategy and other analytical tools is the objective assessment of price behaviour. This strategy's advantage over classical technical analysis is the real-time assessment of price movements. There is no need to use mathematical functions or indicators for this purpose.

The Smart Money Concept combines several well-known theories used by traders worldwide:

- detecting trends and flat spots

- working on several timeframes, when the situation on the higher one determines the direction of trading and the possibility of searching for moments to make deals on the younger ones

- trading from support/resistance levels with the identification of false and true breakdowns

- using Price Action patterns or candlestick combinations to find the optimal point to enter the market and close positions.

Undoubtedly, this theory has practical value. It builds an explicit algorithm that can be used even by a newcomer to start trading profitably.

Pros and cons of SMC

There is a heated debate in the trading community about the Smart Money Concept. The opinions of its opponents are generally based on the following statements.

- This theory seems to be unsubstantiated. There is no recorded evidence in financial market trading that the situations and patterns considered in the SMC directly result from Smart Money manipulation. Moreover, most of them were described by the classics of trading and investing in the times when there were no small (retail) participants in the market. Nevertheless, all these principles worked perfectly well a hundred years ago and continue to work today. In addition, on the same American stock market, the total funds of retail participants reach only 20% of the total volume. This makes them not such a desirable target for hunting by Smart Money, as the author of the concept tries to present.

- Perhaps, until proven otherwise, the SMC explains how the big players behave in the market and influence the price, but it does not offer the possibility of trading 'like Smart Money'. The system provides to follow them, which can actually bring profit. This can be confirmed by Michael Huddleston's statement that the strategy does not even give 90% of profitable trades, while, in his own words, Smart Money always turns out to be a winner. Besides, many simpler TSs in trading implement this approach of following the market. Traders wishing to earn a stable income need only familiarise themselves with them and follow the rules.

- The system is indeed viable, but it cannot claim to be a brilliant discovery in trading. Combining long-known principles and new names for well-known levels and patterns is not a unique innovation for which those wishing to study SMC trading should pay fabulous money.

The above does not mean there is no rational and valuable content in the Smart Money Concept. Traders familiar with the concept note its positive aspects.

- No indicator is needed to trade using the system. Traders get used to analysing the market state only based on the price chart, which significantly speeds up decision-making and, eventually, makes it possible to get more profit.

- The algorithm contains a logical sequence, which makes it possible to understand at any moment what is happening to the price and the probable scenarios for the development of the situation.

- The SMC incorporates much of Price Action (PA), bringing many traders steady income. However, PA is more comprehensive, multifaceted, and challenging to learn. Understanding even a part of it in a new wrapper of the Smart Money Concept will undoubtedly give traders effective tools for working in the markets.

- With the right approach to capital and risk management, even a 60% probability of profitable trades (and in the Smart Money system, it is still higher) brings traders a stable income over the distance.

Thus, the Smart Money Concept as a 'theory of actions of big players' against smaller financial market participants does not seem to be sound. Nevertheless, it is pretty acceptable as a trading system, as it uses time-tested principles, builds a complete algorithm on its basis, and allows traders to receive stable profits.

How to trade with the SMC

The Smart Money Concept in trading involves tracking the actions of the largest banks, investment backdrops, and other 'sharks' of the financial market. Therefore, traders need to learn how to find zones of interest of these players and work with fundamental data and candlestick charts.

A brief algorithm for trading within the Smart Money concept is as follows.

- Collect and analyse current market data. Check the economic calendar.

- Determine the imbalance of supply and demand. Search for positions that may be of interest to Smart Money.

- Analyse trade volumes to track the actions of major players.

- Search for confirmations using candlestick charts.

- Identify entry points and place pending orders to limit losses in case of a market decline.

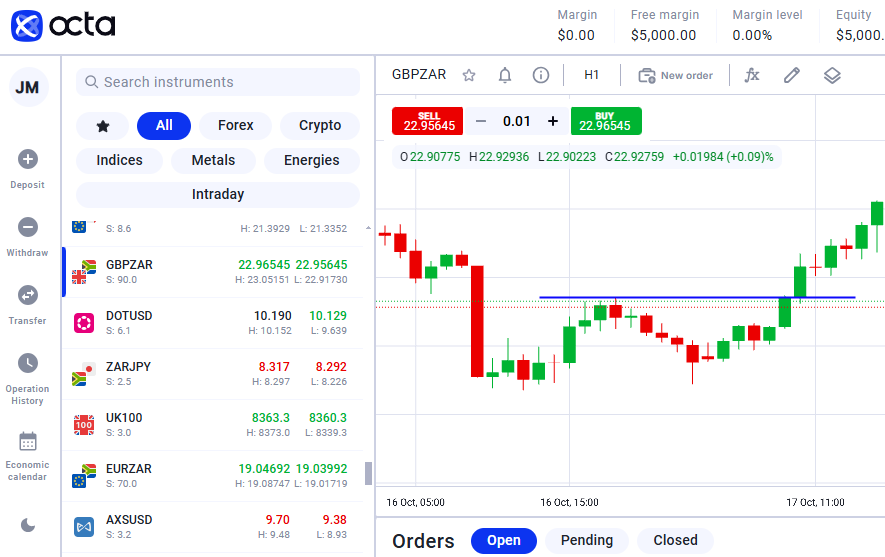

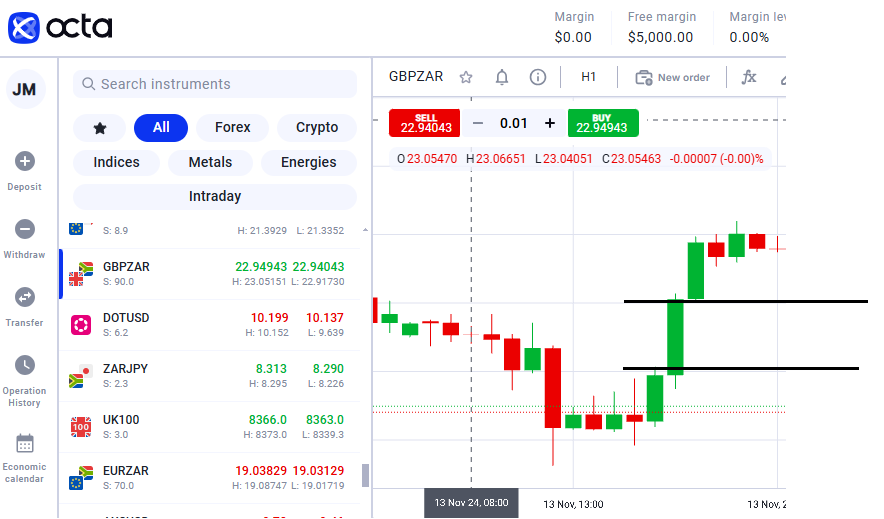

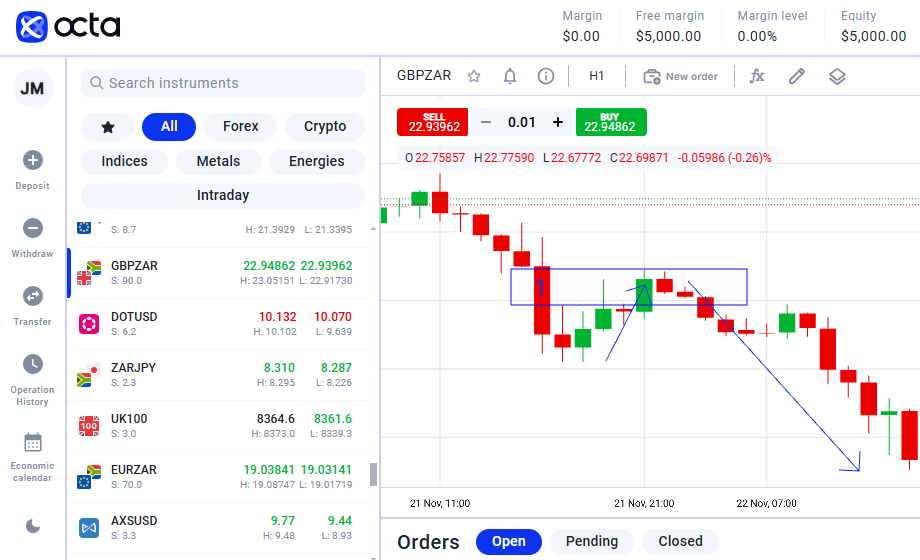

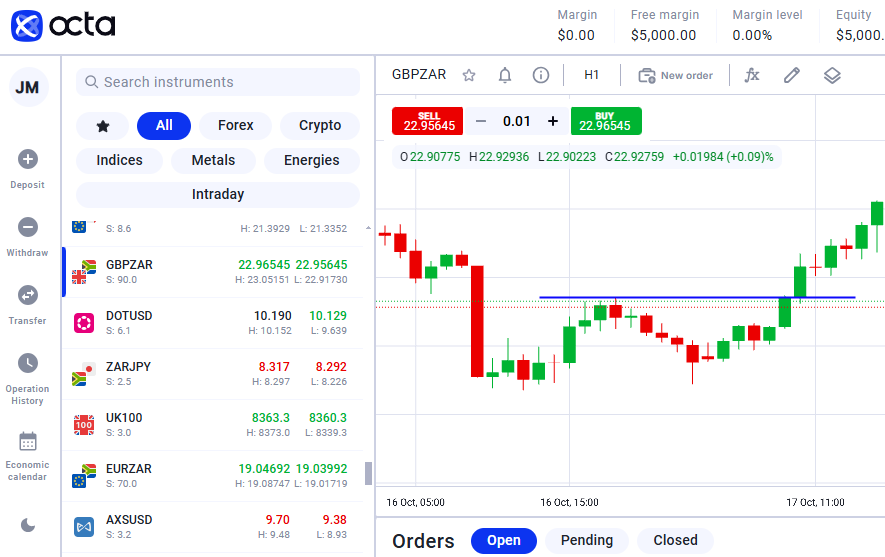

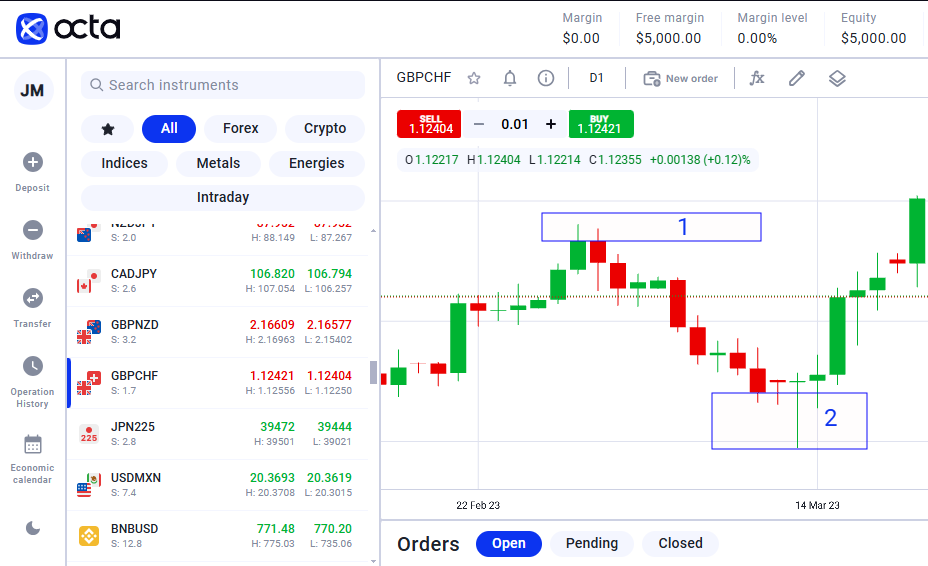

The chart below shows how to trade the FVG—one of the strategies of ICT / SMC.

In SMC, the market comes to fill in the gaps left to balance. The FVG left during the bearish trend is filled in by the market pullback to these areas.

To analyse the behaviour of major players, you need to learn to see the peculiarities of the market structure through the prism of Smart Money. This will help you determine the direction of the trend. Knowing where the price is going makes it easier to decide.

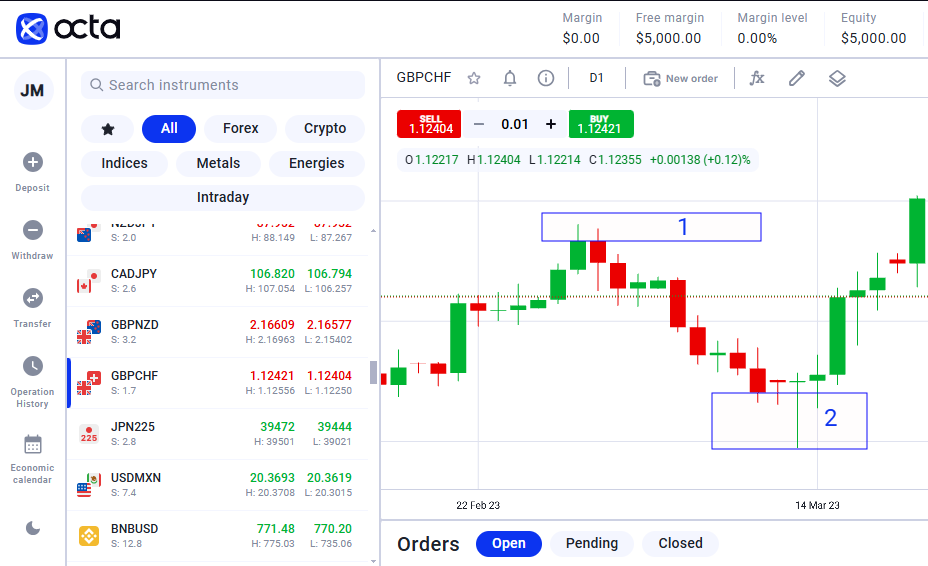

For this purpose, it is essential to understand the term 'Swing structural points' and find significant minimums and maximums—the Swing low and the Swing high. These terms refer to the places where the price reverses. They are usually labelled as follows:

- Higher high (HH)

- Lower high (LH)

- Higher low (HL)

- Lower low (LL)

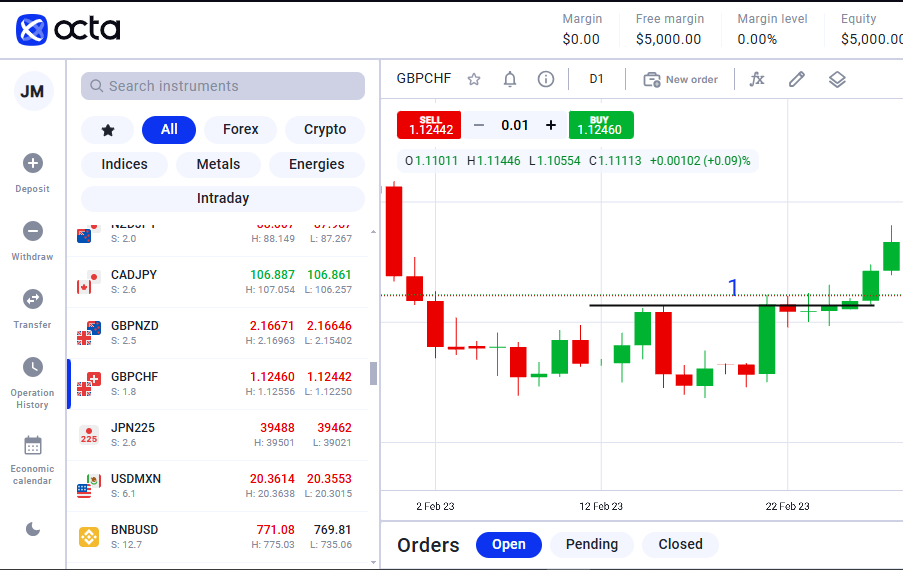

The structure of the Smart Money market can be in three states.

- Upward—when each High and each Low are above the previous value. With such a development, it can be concluded that significant capital will move upwards.

- Downward—if subsequent values are consistently lower than the previous ones, there is a high probability that Smart Money will move downwards.

- Consolidation—the maximum and minimum points are approximately at the same level and have not been updated. This usually indicates that the big players are gaining and distributing assets. After a long phase of consolidation, there are often sharp movements in the market.

Final thoughts

- Smart Money is the money of hedge funds, pension funds, and similar large players, which are managed by professionals.

- The Smart Money Concept in trading involves tracking the actions of major banks, investment funds, and other financial market giants.

- Michael Huddleston, the creator of the Smart Money Concept, has based his strategy on classic technical analysis tools and real-time assessment of asset price movements.

- Some traders consider the Smart Money Concept to be unproven, but the theory has practical application.

- For SMC trading, analyse the behaviour of major market players, track the Swing structural points, and try to predict the trends based on this data.